Behind the Numbers: Mastering The Balance Sheet

Posted by Emily on 29th Oct 2023 Reading Time:

In the UK, businesses must prepare and submit balance sheets annually. But what exactly is a balance sheet, and why is it crucial? This easy-read guide breaks it down for you.

What Is a Balance Sheet?

Imagine a balance sheet as a snapshot of your business's financial well-being at a particular moment. It's a document that helps you, at a glance, understand the financial strengths and weaknesses of your business.

Unpacking the Balance Sheet

A balance sheet is a financial statement giving a comprehensive view of a company's financial affairs. It outlines the company's assets (what it owns), liabilities (what it owes), and shareholders' equity (investment in the business) - essential for assessing the company's financial trajectory.

Why Should You Care About the Balance Sheet?

For UK businesses, balance sheets aren't just necessary for compliance; they're fundamental to understanding your financial standing. They give insights into how your business has handled money, making them indispensable for financial transparency and decision-making.

The Pulse of Financial Health

Consistent balance sheets are like having a health tracker for your business. They can aid in securing investments or loans by demonstrating your financial stability. Furthermore, they can act as an early warning system, identifying financial pitfalls like cash flow shortfalls and prompting a review of strategies like credit control.

Informed Decisions Stem from Clarity

Regularly reviewing your balance sheet helps you make savvy business decisions. Analysing trends in your financial data can embolden investment initiatives or highlight when it's time to tighten the purse strings. The key is not just in the numbers themselves but in their fluctuations and trends.

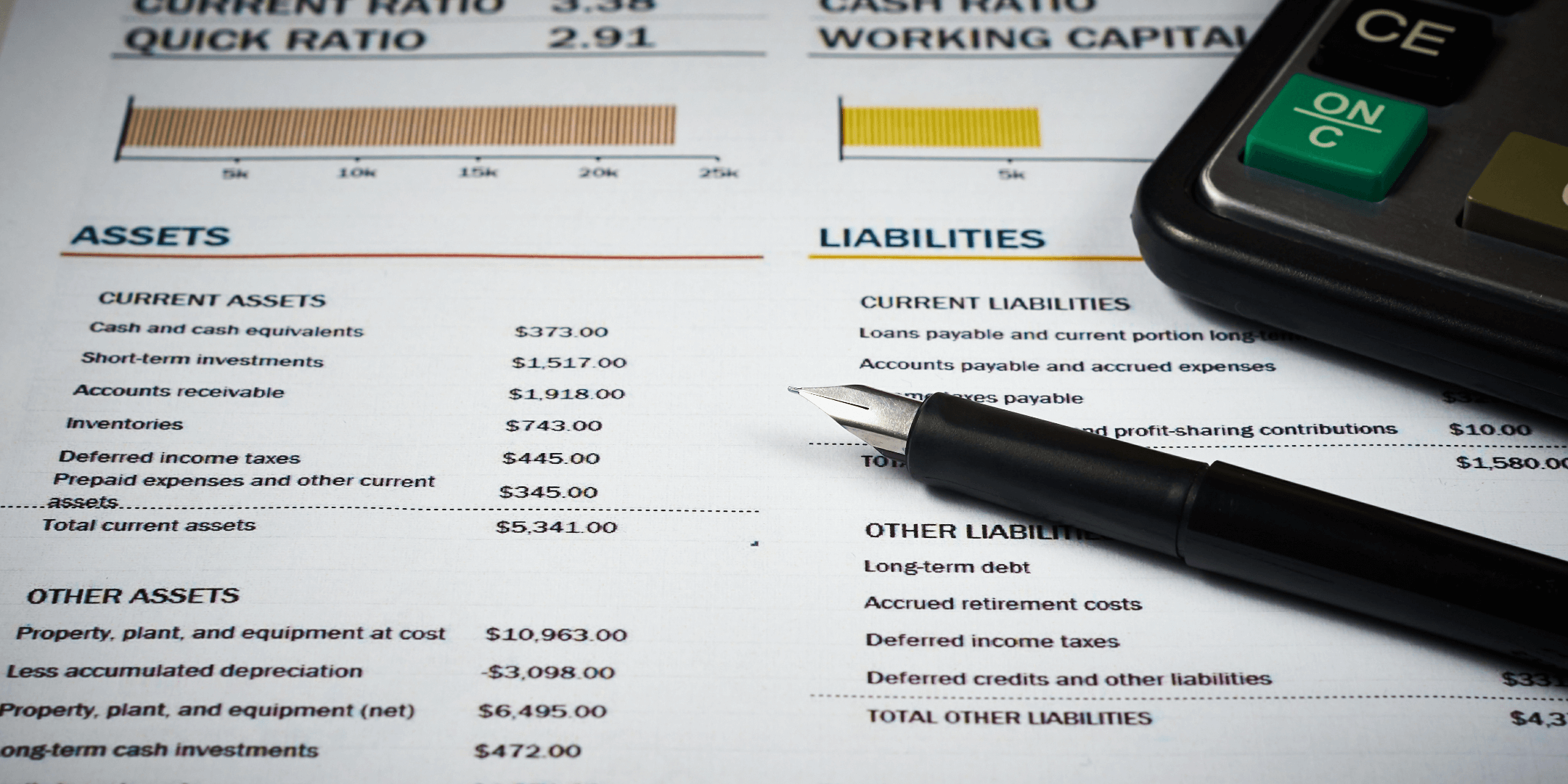

Dissecting the Balance Sheet

Balance sheets vary across businesses but are generally split into three categories: assets, liabilities, and equity. The specific items in these categories depend on the business type. For instance, a digital service provider's balance sheet wouldn't include inventory, unlike a retail business.

Here's a breakdown:

- Assets: Current assets (easily convertible to cash within a year, like money owed by customers) and noncurrent assets (long-term resources, such as property).

- Liabilities: Current liabilities (debts or bills due within a year) and long-term liabilities (debts repayable over a longer period)

- Shareholder's equity: The money invested into the business.

Interpreting a Balance Sheet

Understanding your balance sheet involves examining how its elements interact and change. For instance, a high asset-to-liability ratio might indicate untapped cash potential, while more liabilities than assets could signal financial danger, necessitating strategies to boost cash flow.

Crunching the Numbers

To get more from your balance sheet, employ financial ratios:

- Working capital ratio for insight into operational efficiency and short-term financial health.

- Financial gearing ratios to gauge your business's dependency on borrowed funds.

Maintaining an up-to-date Balance Sheet

Balance sheets should be living documents, updated with every significant financial activity, be it an asset purchase, a liability settlement, or changes in investment. This ensures it remains an accurate reflection of your business's financial status.

Balance Sheets and Cash Flow: The Connection

While not a cash flow statement, your balance sheet complements it. Updating it supports accurate cash flow forecasting, which is essential for anticipating financial obligations like taxes, pension contributions, or supplier payments.

In Conclusion: Your Business's Financial Compass

A well-maintained balance sheet is pivotal for effective financial management. It not only enhances cash flow visibility but also arms you with the information necessary to secure funding and make advantageous decisions throughout your business journey.