Budget Breakdown: Jeremy Hunt's Latest Financial Blueprint

Posted by Emily on 9th Mar 2024 Reading Time:

Jeremy Hunt announced several measures in his latest Budget in a significant speech that will influence the UK's economic direction. These measures are crucial for individuals and businesses as the country heads toward the next general election later this year. This concise overview distils the essential points and implications for our readers.

Taxation

- A reduction in National Insurance by 2p affects employees and the self-employed.

- Despite the cut, income tax and National Insurance thresholds will not increase, leading to higher payments due to fiscal drag.

- The non-dom tax system is set to be overhauled by April 2025, introducing a fairer framework for UK residents with a permanent home overseas.

- Savers are encouraged through a new £5,000 ISA allowance for "UK-focused" shares, pending a detailed consultation.

Benefits & Income Support

- Child benefit eligibility extends to households with a highest earner of up to £60,000, with partial benefits up to £80,000.

- The government eases the financial strain by offering a longer repayment term for emergency budgeting loans and continues to support those facing cost-of-living challenges.

Alcohol, Tobacco, and Vaping

- The duty on alcohol is frozen until February 2025, with a forthcoming tax on vaping products in October 2026 to ensure it remains a cheaper alternative to smoking.

- Tobacco duty escalates by £2 per 100 cigarettes, maintaining the cost advantage of vaping.

Transport & Energy

- Fuel duty remains frozen, extending the 5p cut, while the "windfall" tax on energy firms' profits extends until 2029.

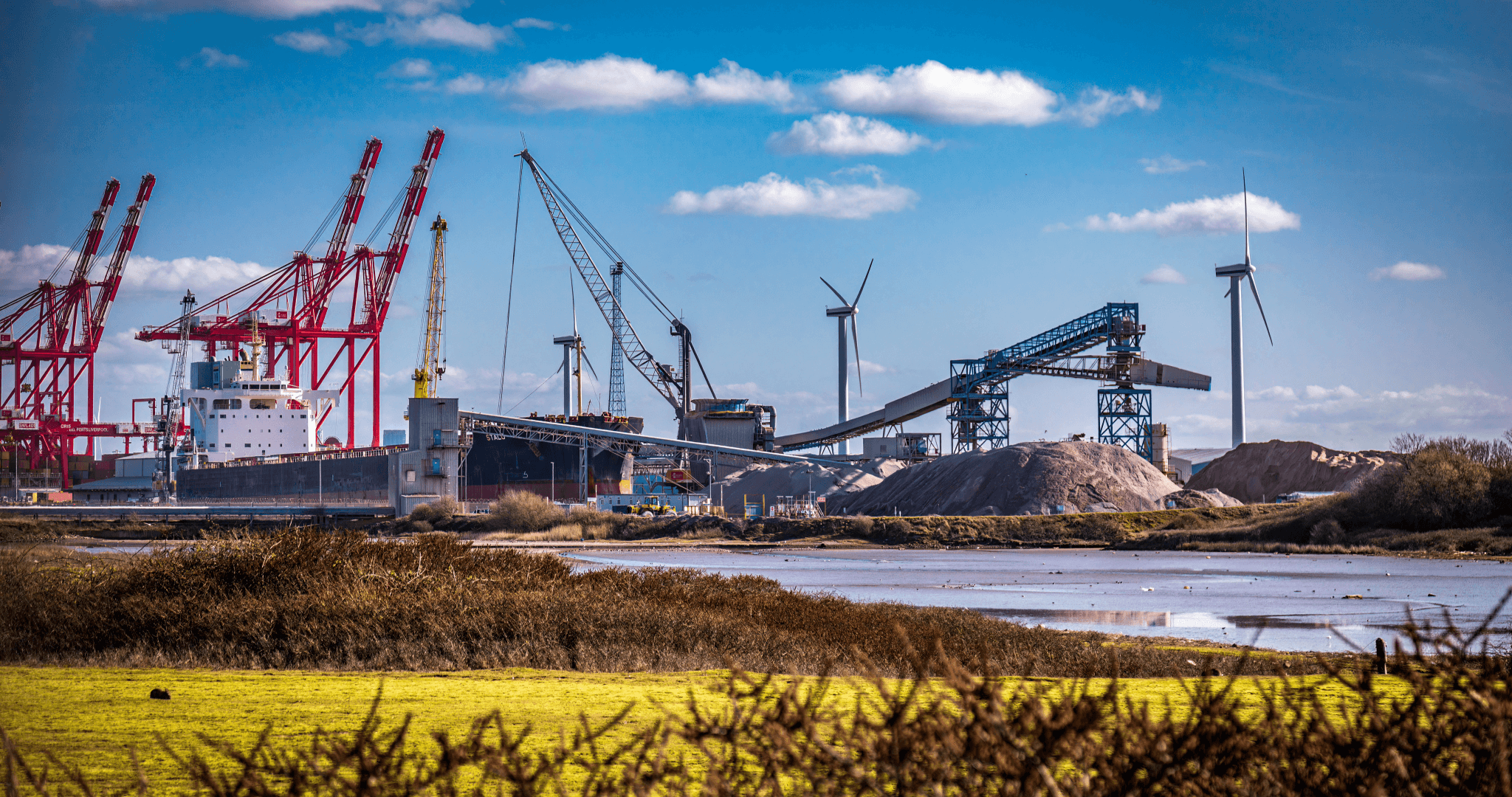

- Significant investments include £160m for the Wylfa nuclear site and £120m in green energy projects, underlining the government's commitment to sustainable development.

Housing

- A reduction in capital gains tax on property sales and the elimination of tax breaks for holiday let properties signal a shift in housing policy.

- The end of a stamp duty break for bulk property purchases in June represents a tightening of tax benefits in real estate.

Economic Forecasts & Public Spending

- The UK economy is set to grow modestly, with inflation expected to decline, illustrating cautious optimism in the financial outlook.

- As a percentage of GDP, public debt shows slight increases. Yet, government spending on crucial sectors like the NHS demonstrates a commitment to public welfare.

Business

- VAT registration thresholds rise, and tax reliefs for cultural productions become permanent, indicating support for the entrepreneurial and creative sectors.

As we analyse these changes, the Budget aims to balance growth, fairness, and fiscal responsibility. The adjustments in taxation, benefits, and strategic investments reflect an effort to navigate economic challenges while fostering a conducive environment for businesses and individuals.

We encourage our readers to share their perspectives and questions in the comments below. How do these measures affect you or your business? What further information or analysis would you find helpful?