Challenging Times Ahead for UK Hotels: Wage Increases and Weather Woes

Posted by Emma on 4th Jun 2024 Reading Time:

The UK hotel industry is grappling with a range of challenges as recent increases in the national minimum wage (NMW) and adverse weather conditions exert pressure on profits. According to research by consultancy RSM, while the cost of hotel rooms has surged post-pandemic, the rise in labour costs and a rainy spring have strained the bottom lines of many hotel operators.

In April 2024, workers celebrated a 9.8% rise in the national living wage (NLW) to £11.44, providing much-needed relief amid soaring living costs. However, this wage hike has led to increased labour costs, with the average cost per available room rising from £15.32 in March to £16.62 in April. Despite higher room rates, operating profits remained stagnant as a percentage of turnover, highlighting the financial strain on hoteliers.

UK hotels have attempted to offset these pressures by increasing room rates, with average daily rates rising from £110.24 before the 2020 lockdowns to £139.51 in April 2024. However, this increase has not translated into higher profits, as operating profits have remained flat at 31.4% of revenue, significantly below pre-pandemic levels.

Chris Tate, head of hotels and accommodation at RSM UK, noted, "While UK hotels have been able to charge higher room rates compared to pre-pandemic levels, ongoing cost pressures, including the rise in the national minimum wage, are chipping away at their operating profits."

The wettest April in nearly two centuries, with 111mm of rainfall, has further complicated matters. The poor weather has kept consumers away from hotels, impacting occupancy rates, which remained flat at 74.5% in April, compared to 77.6% pre-pandemic.

Thomas Pugh, economist at RSM UK, explained, "April was a tough month for consumer businesses with miserable weather keeping them out of shops and hotels. However, there are good reasons to expect spending on hospitality services to grow from here."

Despite these challenges, there is cautious optimism for the future. Analysts predict that as inflation drops and tax cuts are implemented, disposable incomes will rise, boosting consumer spending on hospitality services. Additionally, improved weather during the summer months and increasing consumer confidence are expected to relieve the struggling hotel sector.

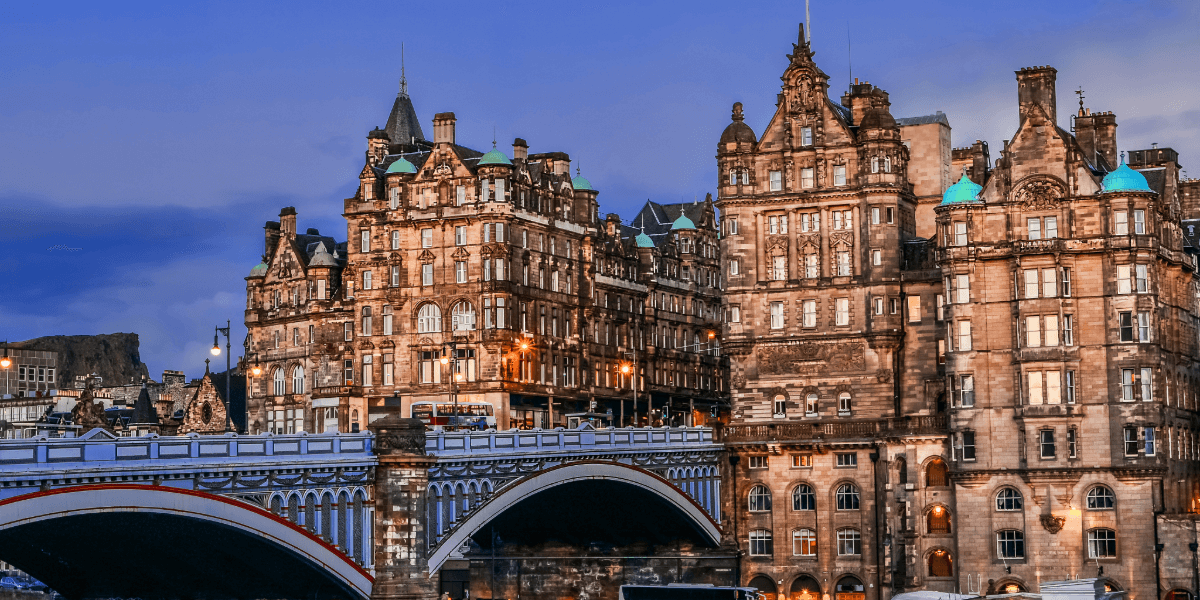

Kalindi Juneja, CEO of Pride of Britain Hotels, highlighted the regional disparities, noting that while southern England faces challenges, northern England and Scotland have seen some gains. Analysts from Hotstats also warn that maintaining the revenue growth seen in 2023 will be difficult, with several cities, including London and Manchester, potentially facing further revenue and profit challenges.

Hoteliers are adapting their pricing strategies to navigate these turbulent times. Tej Walia, managing director of Foxhills Club and Resort, emphasised the importance of a demand-based strategy, using artificial intelligence tools to optimise pricing daily. Walia noted, "Operators are continuing to hold on to rate. When we tried lowering rates, it had no effect on demand, so we increased them again."

Similarly, Jen Paylor, group revenue director at RBH Hospitality, pointed out that while rate resistance has been observed, occupancy remains steady. She added, "Last year's phenomenal rate growth has plateaued, and now we are seeing more stable conditions."

With costs remaining high and uncertainty looming, hoteliers hope for a successful summer season. However, unpredictable weather and last-minute booking trends make forecasting challenging. Walia expressed concerns about the impact of poor weather on domestic travel, while Juneja remains optimistic about improved performance in the coming months.

The UK hotel industry faces a complex landscape marked by rising costs and external pressures. As hoteliers navigate these challenges, strategic pricing and a hopeful outlook for increased consumer spending are key to weathering the storm.