Compass Unveils $500 Million Buyback Following Impressive Profit Surge

Posted by Emma on 22nd Nov 2023

In a remarkable year of growth, the world's leading catering company, headquartered in Chertsey, Surrey, has demonstrated its financial strength by boosting dividends by a third and announcing a $500 million (£399m) return to its shareholders. A substantial increase in annual profits fuelled this momentous achievement.

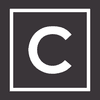

Compass secured an unprecedented volume of new contracts during its fiscal year, which concluded on September 30, 2023. These contracts encompassed managing cafeterias in corporate offices, schools, healthcare facilities, and sports stadiums. Compass inked deals worth an astounding £2.7 billion, with half of this sum stemming from businesses and venues that outsourced their catering operations for the first time. Notable additions to Compass's portfolio include National Gas, Moorfield Eye Hospital, and Unity Place, the new home for Santander in Milton Keynes.

CEO of Compass, Dominic Blakemore, remarked on the shifting landscape, saying, "We're witnessing a growing trend towards outsourcing. Navigating the regulatory landscape is challenging: with sugar and salt regulations, health and safety protocols, and sustainability reporting, it becomes increasingly complex for those managing their own food programs in offices, schools, or hospitals. Our expertise is invaluable in addressing these multifaceted requirements."

For the year ending in September, Compass recorded a remarkable turnover of £31 billion, a staggering 21.6% increase compared to the £25.5 billion generated in 2022. Pre-tax profits surged by an impressive 19.2% to £1.75 billion, up from £1.47 billion.

In addition to securing new contracts, Compass successfully implemented an average price increase of approximately 7%, a strategic move aimed at mitigating the impact of inflation.

To reward its stakeholders for this robust and well-rounded performance, Compass will pay a final dividend of 28.1p per share in January. Over the course of the year, Compass shareholders will have received 43.1p per share, marking a 37% increase from the previous year's 31.5p per share. This will be complemented by a share buyback program of up to $500 million.

Blakemore emphasised the company's positive outlook, stating, "Despite some macroeconomic uncertainty, favourable market dynamics persist, and with a global market share of less than 15% and roughly 50% of the market still self-operated, we have an exciting growth opportunity ahead."

Compass is the world's largest provider of food services, managing cafeterias in thousands of educational institutions, healthcare facilities, cultural institutions, and corporate offices. Additionally, it provides catering services for some of the world's most significant events and festivals, including the Wimbledon tennis championships and the O2 Arena. Compass employs approximately 560,000 individuals across 35 countries, with around a third being skilled chefs.

Compass anticipates operating profit growth of 13% in the upcoming year, achieved through single-digit revenue growth and improved profit margins. Analysts have noted that both the results and the outlook align with their expectations. However, a reminder of increased taxes in the UK led to a 2.2% dip in Compass shares, closing at £20.48.

Fintan Ryan, a food and beverage industry analyst at Goodbody, added that there may have been some profit-taking among investors, given that Compass shares were trading close to their all-time high.

We encourage you to share your thoughts on Compass's impressive performance and future prospects by commenting below.