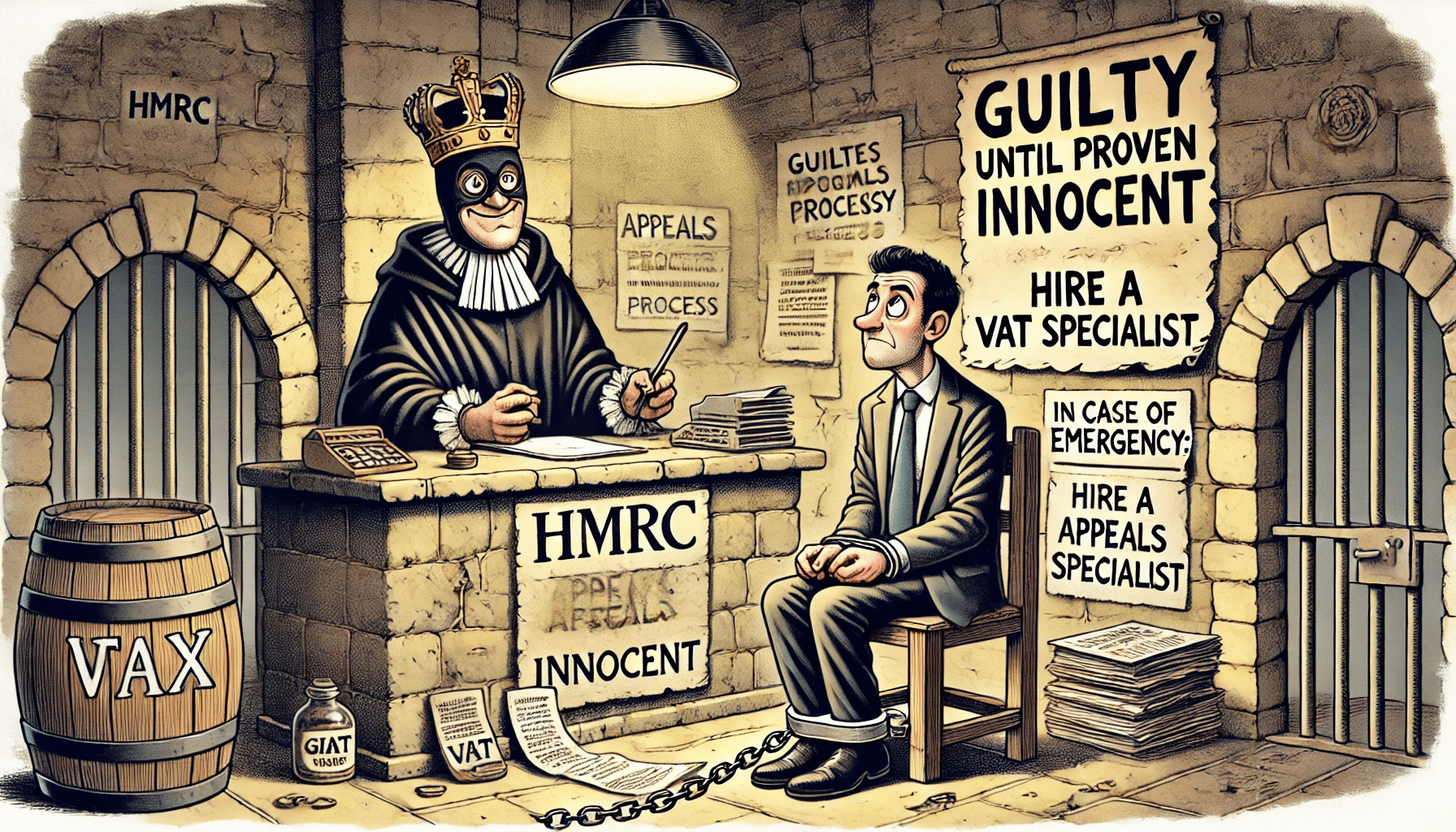

Getting VAT Wrong? How to Challenge HMRC and Reduce Penalties

Posted by Les Howard on 21st Mar 2025 Reading Time:

This guest article by Les Howard, a renowned VAT specialist and two-time Ceres Podcast guest, sheds light on the history of taxation—from ancient times to modern VAT. Curious to hear more from Les? Check out episodes 181 and 186 of the Ceres Podcast, where he joins Stelios for insightful discussions. For more, follow Les Howard on LinkedIn.

HMRC has broad powers that it uses against taxpayers who get VAT wrong, whether it is accidental or deliberate, or they think it is wrong (even if it is correct!)!

The variations are huge, so this article cannot address every possible eventuality.

- There are modest penalties for late submission or late payment of VAT Returns. But if failures continue, the penalties start to increase. If you struggle to submit or pay, speak to your Accountant in the first instance. Then, contact HMRC to discuss. Ideally, you can make a plan to bring everything up to date.

- Where sales are understated, or the split of S/R and Z/R is incorrect, then the potential penalties are much more expensive.

Of course, HMRC will want to assess the amount of VAT, which, they think, is understated. And, of course, they will want to maximise that amount!

All this means any assessment and penalty is liable to challenge. Sadly, I come across too many instances where the taxpayer fails to take this opportunity.

Any assessment is likely to be estimated; HMRC's methodology may be challenged at a number of points; in recent years, they have been less-than-careful in this, so the opportunity is very real.

HMRC calculate any penalty based on the amount of VAT understated multiplied by a percentage based on 'taxpayer behaviour' - a lesser percentage (up to 30%) for a careless penalty; a higher percentage (up to 70%) where the taxpayer has deliberately made errors, and (up to 100%) when deliberate and concealed.

The amount of the penalty may then be mitigated by the taxpayer's assistance in resolving matters. HMRC refer to the quality of the taxpayer's disclosure. Broadly, if he assists in calculating arrears, communicating with HMRC, etc., then the penalty percentage may be reduced.

The penalty calculation may also be challenged. HMRC issue more deliberate penalties than careless ones, so one obvious consideration is the penalty category. Then, there is the question of mitigation; for example, has HMRC allowed a sufficient penalty reduction?

This is where an Accountant or VAT Specialist can assist.

Loved this piece? Do you have industry thoughts or insights to add? We'd love to hear from you—drop us a line at info@worldofceres.com!