How KFC is fighting to stay relevant in a changing chicken market

Posted by Emma on 29th Oct 2025 Reading Time:

For decades, Kentucky Fried Chicken’s iconic red-and-white buckets have symbolised comfort food and family gatherings. First introduced in 1957, they turned fried chicken into an American dining staple — and made KFC one of the world’s most recognisable brands.

But in 2025, those same buckets represent a problem. As consumers turn to handheld, boneless meals that suit life on the go, KFC is finding its core offering — chicken on the bone — increasingly out of step with modern eating habits.

The Shift Away from the Bone

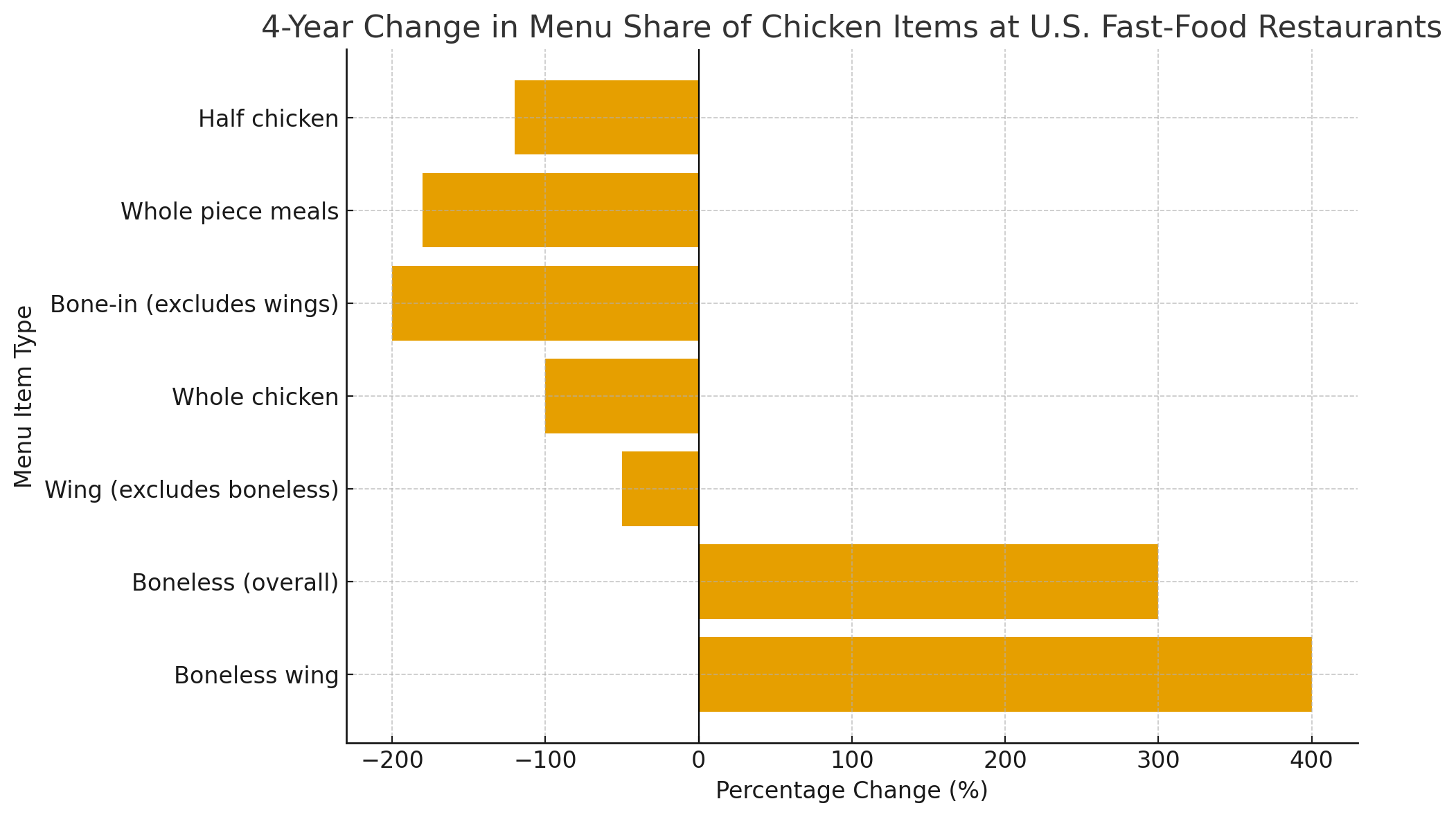

In the United States, the trend is stark. Menu listings for bone-in fried chicken have dropped by 72% over the past four years, while listings for boneless wings, tenders and sandwiches have risen by 29%, according to market research firm Datassential.

The reason is simple: convenience. Around 26% of fast-food meals are now eaten in cars, where drumsticks and thighs simply don’t fit the bill. As one customer told The Wall Street Journal, eating chicken on the bone while driving “would be such a greasy mess.”

This shift has fuelled the rise of competitors such as Chick-fil-A, Raising Cane’s and Dave’s Hot Chicken, all of which have built empires around sandwiches and tenders. Raising Cane’s saw U.S. sales grow by 32% last year, while Dave’s Hot Chicken surged by 57%. KFC, by contrast, has endured six consecutive quarters of declining same-store sales.

The Colonel Ain’t Smiling

For a brand that once defined fried chicken, this marks a humbling moment. KFC, which dominated the category for decades, now ranks fourth in U.S. sales — and could soon be overtaken by Wingstop, according to Technomic.

To stem the decline, parent company Yum Brands has shaken up KFC’s U.S. leadership, appointing Catherine Tan-Gillespie, its former global chief marketing officer, to lead a turnaround. Her mission: modernise the menu, sharpen the marketing, and remind America “exactly who we are.”

“The Colonel would not be happy about our market share — and we’re serious about reminding America exactly who we are.” — Catherine Tan-Gillespie, KFC U.S. Head

That message has taken a cheeky tone. Recent campaigns feature a glowering Colonel Sanders with the line “The Colonel ain’t smiling” — a nod to the brand’s determination to fight back.

Reinventing the Menu for a New Generation

KFC’s comeback plan begins with the menu. The brand has reintroduced its Original Honey BBQ Sandwich, first launched in the 1990s, now priced competitively at $3.99 — and pointedly promoted as “bigger than Chick-fil-A’s AND available on Sundays.”

It has also revived fan favourites such as potato wedges, dropped five years ago, which returned with a viral social media post captioned simply: “HERE, DAMN.” The post racked up over 80 million views, proving that nostalgia — when served right — still sells.

Beyond the classics, KFC is trialling a new concept, “Saucy by KFC”, featuring chicken tenders, 11 sauces, and a simplified, trend-led menu. Yum Brands has already acquired 13 restaurant sites to convert into Saucy units, suggesting serious intent behind the experiment.

The Global Chicken Shift — and the UK’s Own Battle for Bites

KFC’s reinvention isn’t just an American story. The same shift toward boneless, on-the-go chicken is happening in the United Kingdom, where competition is fierce and expanding.

U.S. chains such as Slim Chickens and Popeyes Louisiana Kitchen have rapidly gained traction with British diners, offering high-quality, sauce-driven chicken that appeals to younger audiences. And in a sign of intensifying competition, Chick-fil-A — the U.S. brand that helped redefine the chicken sandwich — has just opened its first permanent restaurant in Leeds, marking the start of its UK expansion.

Meanwhile, Britain’s own fried chicken landscape is thriving. Established names like Morley’s, Chicken Cottage, Dixy Chicken, Southern Fried Chicken and Chicken Land continue to dominate high streets. But newer independents — including Mother Clucker, Coqfighter, Butchies, Chick ’n’ Sours, Lucky’s Hot Chicken and WonderBird Co — are shaking things up with modern, chef-driven takes on fried chicken.

The result is a crowded and fast-evolving marketplace, where KFC’s traditional model faces pressure from all sides. To remain the global leader, it must not only reclaim its American roots but also evolve fast enough to stay relevant in markets where competition is exploding.

Legacy Meets Reinvention

KFC’s story has always been one of reinvention. Founded in the 1930s by Harland “Colonel” Sanders, who perfected his secret blend of 11 herbs and spices in a small Kentucky café, the brand grew into an international phenomenon by the 1960s.

Its buckets symbolised abundance, its founder embodied authenticity — and for generations, its chicken defined the category. But nostalgia alone cannot sustain a brand in a world driven by convenience, novelty and digital connection.

Early signs of improvement offer cautious optimism. According to Placer.ai, KFC’s U.S. footfall is beginning to recover, and its updated menu appears to be resonating with customers once more.

The Road Ahead

KFC’s challenge is clear: modernise without losing its soul. Its future depends on whether it can adapt its legendary recipes to fit a faster, more mobile dining culture — and whether its bold marketing can cut through in a market brimming with new voices.

From the highways of America to the high streets of Britain, the Colonel’s legacy is once again being tested. But if history is any guide, KFC’s willingness to evolve may yet prove that there’s life — and plenty of flavour — left in the bucket.