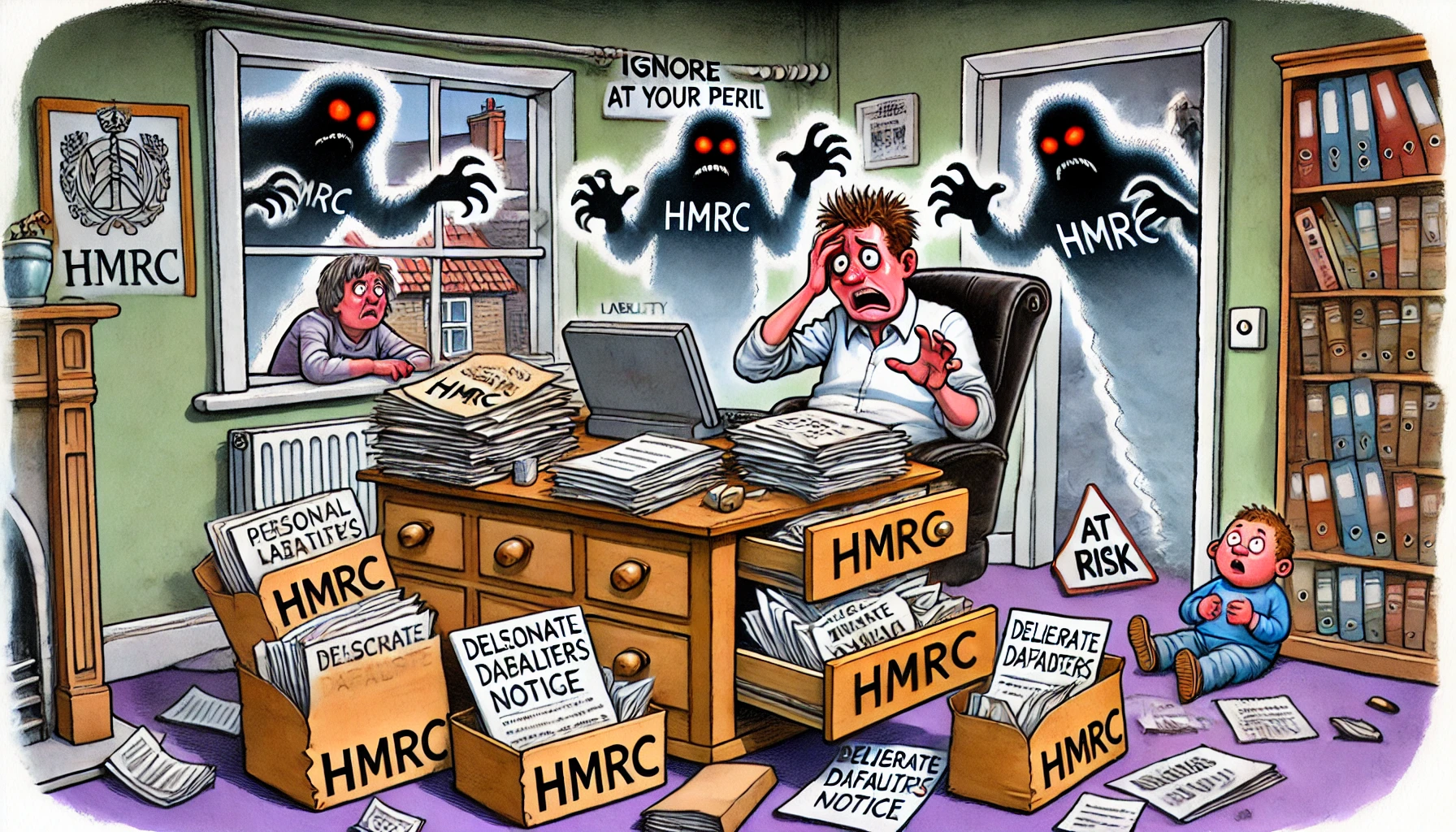

Ignoring HMRC Letters? The Cost Could Be Devastating

Posted by Les Howard on 12th Apr 2025 Reading Time:

This guest article by Les Howard, a renowned VAT specialist and two-time Ceres Podcast guest, sheds light on the history of taxation—from ancient times to modern VAT. Curious to hear more from Les? Check out episodes 181 and 186 of the Ceres Podcast, where he joins Stelios for insightful discussions. For more, follow Les Howard on LinkedIn.

One business advisor I spoke to said that many potential clients of his had a drawer containing unopened letters in brown envelopes, many from HMRC. The business owner didn't know what to do with such correspondence, so he didn't even look at it.

This is not recommended!

If a business fails to address VAT assessments and penalties in good time, where can it lead? The answers are varied but are never good!

If the VAT at stake exceeds £25,000 and the under-declaration is deemed deliberate, HMRC may add you to their list of deliberate defaulters published online every quarter.

Where HMRC deem a taxpayer's behaviour to be deliberate, then a limited company offers little protection. HMRC can assess VAT arrears and penalties for a director or other officer. A Personal Liability Notice is a formal document to this effect. This means HMRC can pursue the individual who, in their opinion, is responsible for the defaults.

If VAT is understated, direct tax (Income tax or CT) will be used, so the amounts to be assessed will roughly double. Once you add penalties, the sums can be eye-watering.

Defaulting persons can be made bankrupt or can lose their house. Their credit record is affected. Starting another business will be almost impossible.

Loved this piece? Do you have industry thoughts or insights to add? We'd love to hear from you—drop us a line at info@worldofceres.com!