Navigating the Crisis: Global Trade's Response to Red Sea Attacks

Posted by Emma on 21st Dec 2023 Reading Time:

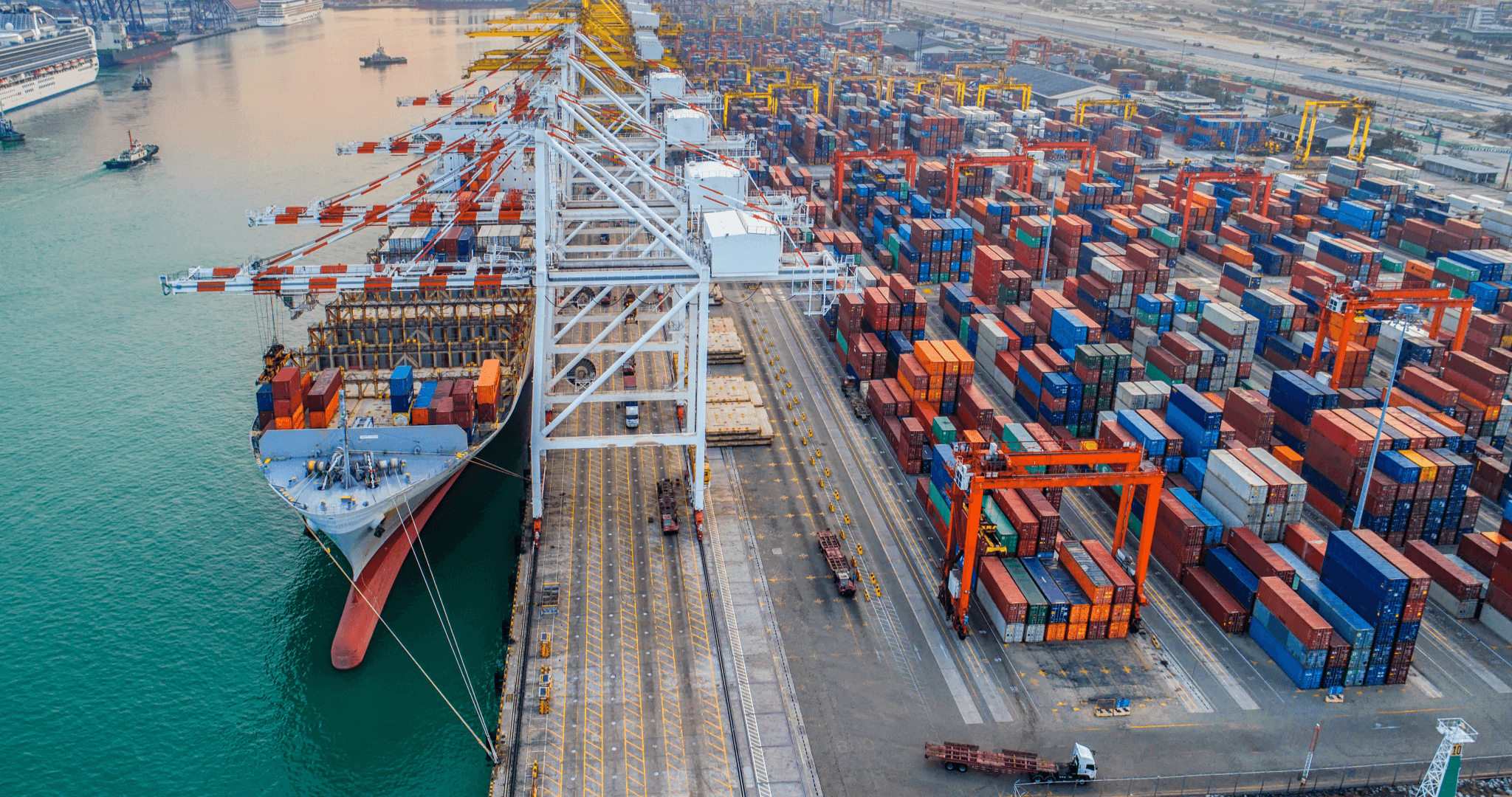

In the face of escalating tensions in the Red Sea, triggered by Iran-backed Houthi militants in Yemen targeting vessels since November 19, businesses are urgently exploring alternative transportation options. This crisis, coinciding with Israel's military activities in Gaza, has severely disrupted a critical trade route that connects Europe and North America with Asia via the Suez Canal, impacting a wide range of industries from toys and apparel to tea and auto parts.

As the situation unfolds, Alan Baer, CEO of OL USA, emphasises the need for companies to prepare for at least 90 days of disruption. The timing, aligning with the holiday season, adds a layer of complexity, with Baer noting the quiet period until January 2, followed by a frantic surge in activity. This challenge is compounded by other global logistics issues, such as the Panama Canal's capacity limitations due to severe drought and upcoming Chinese New Year factory closures.

Exporters increasingly turn to intermodal transport, blending air and sea routes, to bypass the affected area. Jan Kleine-Lasthues, COO of Hellmann Worldwide Logistics, reports a spike in demand for this approach, particularly for consumer goods and high-tech items. This involves sea transport to ports like Dubai, followed by air freight to the final destination, thus avoiding the risky Red Sea zone and the lengthy alternative route around Africa's southern tip.

However, the high cost of air freight, as highlighted by Brian Bourke of SEKO Logistics, poses a significant barrier. Air freight can be up to 15 times more expensive than sea transport, although the latter remains low by historical standards. Despite these costs, companies dealing in high-value goods, like designer clothing and electronics, may increasingly opt for air transport if shipping delays double.

The disruption has major global implications. The Red Sea corridor, used by about 35,000 vessels annually, is integral to global GDP, linking diverse markets and products. U.S. retailers such as Walmart, Target, Macy's, and Nike heavily depend on this route for a vast range of goods.

Companies are responding in varied ways. Tailwind Shipping Lines, affiliated with the German supermarket chain Lidl, has rerouted around the Cape of Good Hope. A Spanish fashion industry source expressed reliance on the U.S.-led task force to secure the route. Additionally, major shippers like CMA CGM are implementing emergency surcharges to offset the costs of Red Sea disruptions.

Below are companies (in alphabetical order) responses to the disturbances:

AB FOODS

The Primark owner is monitoring the situation, but its supply chains are capable of some adjustment, a company spokesperson told Reuters, adding that "so far, we see no need to be concerned".

BASF

The German chemical company does not see disruptions to raw material supply or product distribution but is closely monitoring the situation, a company spokesperson said.

BP

The oil major on December 18 said it had temporarily paused all transits through the Red Sea.

DANONE

The French food group said most of its shipments had been diverted, which would increase transit times. Should the situation last beyond 2-3 months, the group will activate mitigation plans, including using alternate routes via sea or road wherever possible, a Danone spokesperson said.

ELECTROLUX

The Swedish home appliances maker set up a task force to find alternative routes or identify priority deliveries to avoid disruption. It currently sees a limited impact on deliveries.

IKEA

The Swedish ready-to-assemble furniture retailer told Reuters on December 19 that the situation in the Suez Canal would result in delays and may cause availability constraints for specific products. " In the meantime, we are evaluating other supply options to secure the availability of our products," it added.

LIDL

Tailwind Shipping Lines, a German discount supermarket chain unit that transports non-food goods for Lidl and goods for third-party customers, said it was sailing around the Cape of Good Hope for now.

MOSAIC

The U.S. fertiliser company said on December 18 that it had rerouted a couple of U.S.-bound shipments around the Cape of Good Hope.

TSMC

The world's top contract chipmaker said on December 19 that it had a long-established enterprise risk management system in place. After an assessment, it was found that it did not anticipate a significant impact on its operations.

VOLVO CAR

The Swedish automaker said it was affected by the shipping hindrances and was investigating the potential impact. However, the company said it sees no effect on its ability to reach global wholesale and production targets.

WHIRLPOOL

Whirlpool is closely monitoring logistics issues in the Red Sea, the Suez Canal, and the wider region to help mitigate risks as they arise, the appliances maker told Reuters, adding that currently, there is no impact on its business.

In terms of personal experiences, many business leaders are voicing their concerns and strategies. For instance, a spokesperson from Primark highlights their supply chains' adaptability, while a BASF representative assures no immediate disruptions. Similarly, other companies like Danone and Electrolux proactively seek alternative routes and prioritise deliveries to minimise disruptions.

The situation in the Red Sea is a stark reminder of the fragility and interconnectedness of global supply chains. Businesses are forced to adapt rapidly, balancing the urgency of maintaining supply lines with the soaring costs and logistical complexities of alternative transportation methods. The personal testimonies from industry leaders underscore the widespread impact of these disruptions and the necessity for innovative and flexible solutions in the face of geopolitical challenges.