Salmon Farms Face 'Biological' Issues

Posted by Emily on 25th Aug 2023 Reading Time:

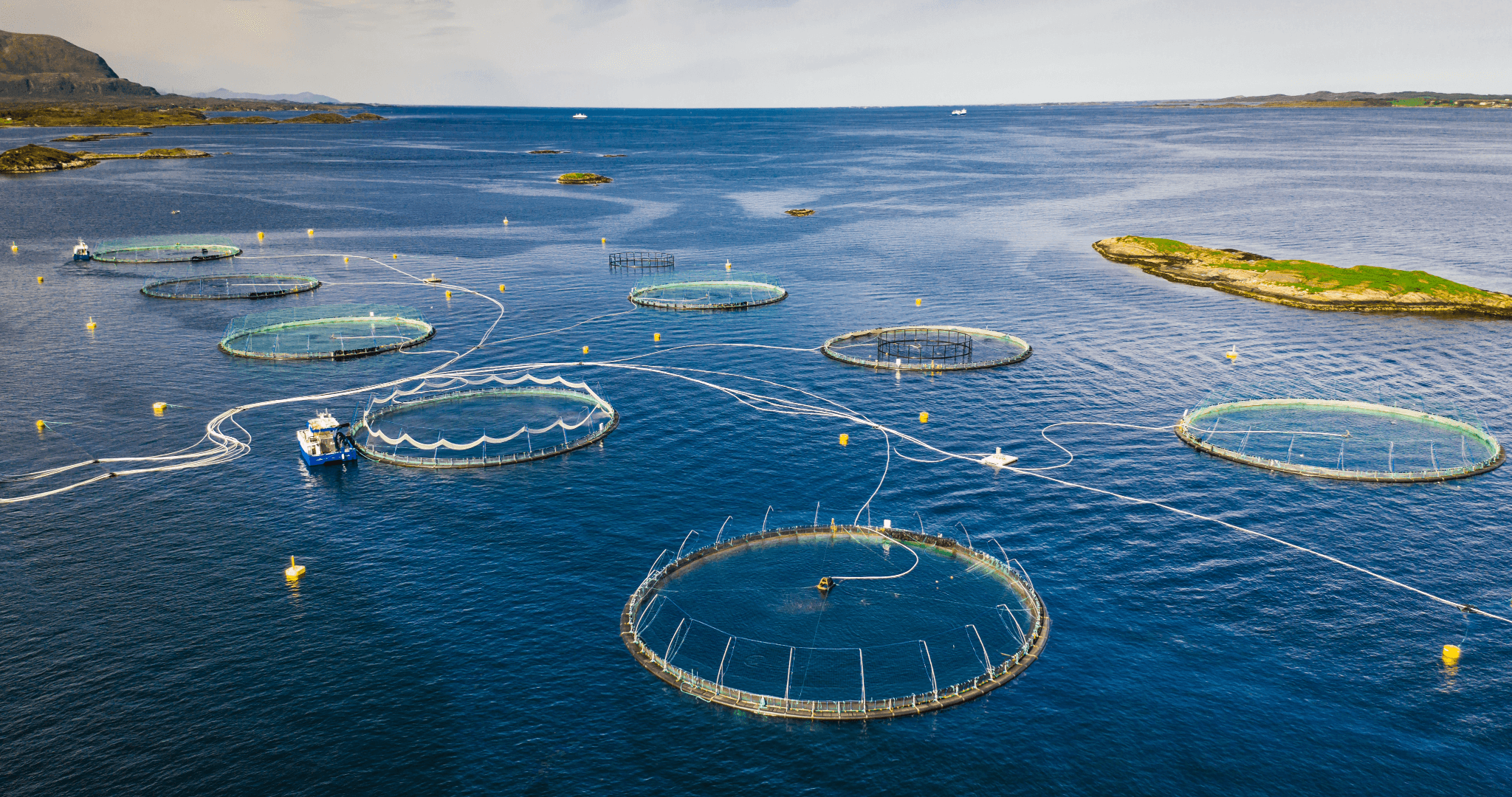

Several of Scotland's leading salmon farms have highlighted ongoing significant "biological" issues. This frequently pertains to challenges like sea lice or illnesses, and there's been added pressure due to notably high sea temperatures, leading to an increased presence of jellyfish.

Leroy, the Norwegian company which owns a 50% stake in Scottish Sea Farms, described the period from April to June as "tremendously challenging". They indicated that issues at their fish farms influenced the typical harvest size. Due to lice infestations, salmon farmers often find themselves compelled to harvest fish prior to them reaching their full growth potential, resulting in increased costs and reduced selling prices.

Leroy stated that its operations in Scotland resulted in costs amounting to £13.2m due to "incident-based mortality". This can signify the need to cull fish stocks if they're infected and not fit for sale. Scottish Sea Farms adjusted their projected annual production to 27,000 tonnes, a reduction from the 38,000 tonnes produced in 2022. Leroy recorded a £4.8m (65m kroner) loss for Scottish Sea Farms in the second quarter, in contrast to a £5.2m (70m kroner) profit during the same time frame the previous year. "This shift can be credited to a testing biological environment," they said, adding, "A gradual recovery is anticipated in the latter half of the year." Scottish Sea Farms refrained from additional comments, pending a market update from their other co-owner, Salmar.

Rising Temperatures

While facing these challenges, Mowi, the globe's largest salmon farmer based in Norway, displayed improved financial results. Their operational pre-tax earnings in Scotland were twice that of the second quarter of the previous year. Furthermore, their harvest increased from roughly 13,000 tonnes to 18,300 tonnes from April to June this year. Despite a remarkable 70% increase in spot prices over the past two years, the industry had to contend with rising feed costs. Mowi reported that "incident-based mortality" at its Scottish locations amounted to 2.7m euros (£2.3m). Their market update noted a "reasonably good biological performance, especially given the unprecedentedly high seawater temperatures in June". These elevated temperatures not only complicated feed storage and handling but also aggravated environmental conditions due to the surge in plankton, algae, and jellyfish.

'Biological Threats'

Bakkafrost, based in the Faroes and having a substantial operation in western Scotland, reported improved financial outcomes compared to the challenging conditions in 2022. They elaborated: "In Scotland, we've encountered hurdles in one farming region, though not as intense as in preceding quarters. This underscores the persistent elevated biological threats." To diminish risks to salmon in sea cages, Bakkafrost is in the process of constructing large tanks to nurture young salmon (smolts) to a more mature size prior to their transfer, more so than in previous years. One such facility is underway in Applecross, Wester Ross. CEO Regin Jacobsen remarked, "For Bakkafrost, the introduction of larger smolts in Scotland is vital to diminish biological threats and enhance biological performance. Thus, expanding hatchery capacity in Scotland is of paramount importance."

Significant Expansion

During the first half of 2023, Scottish salmon exports experienced a 9% growth, with substantial expansion evident in the Asian and American sectors. Recent statistics reveal that Scottish salmon, being the UK's prime food export, had a value of £306m from January to June. The most significant value surges were seen in the USA, China, Poland, and Taiwan. Additionally, the Netherlands, Singapore, Japanese, and Spanish markets witnessed considerable percentage growth. France remains the chief international consumer of Scottish salmon. Even though sales to France dropped by 5% in the initial half of the year, this decline was counterbalanced by a surge in global demand.