Taxed Out: How Policy Shifts Are Gutting Hospitality Jobs in the UK

Posted by Emily on 17th Jul 2025 Reading Time:

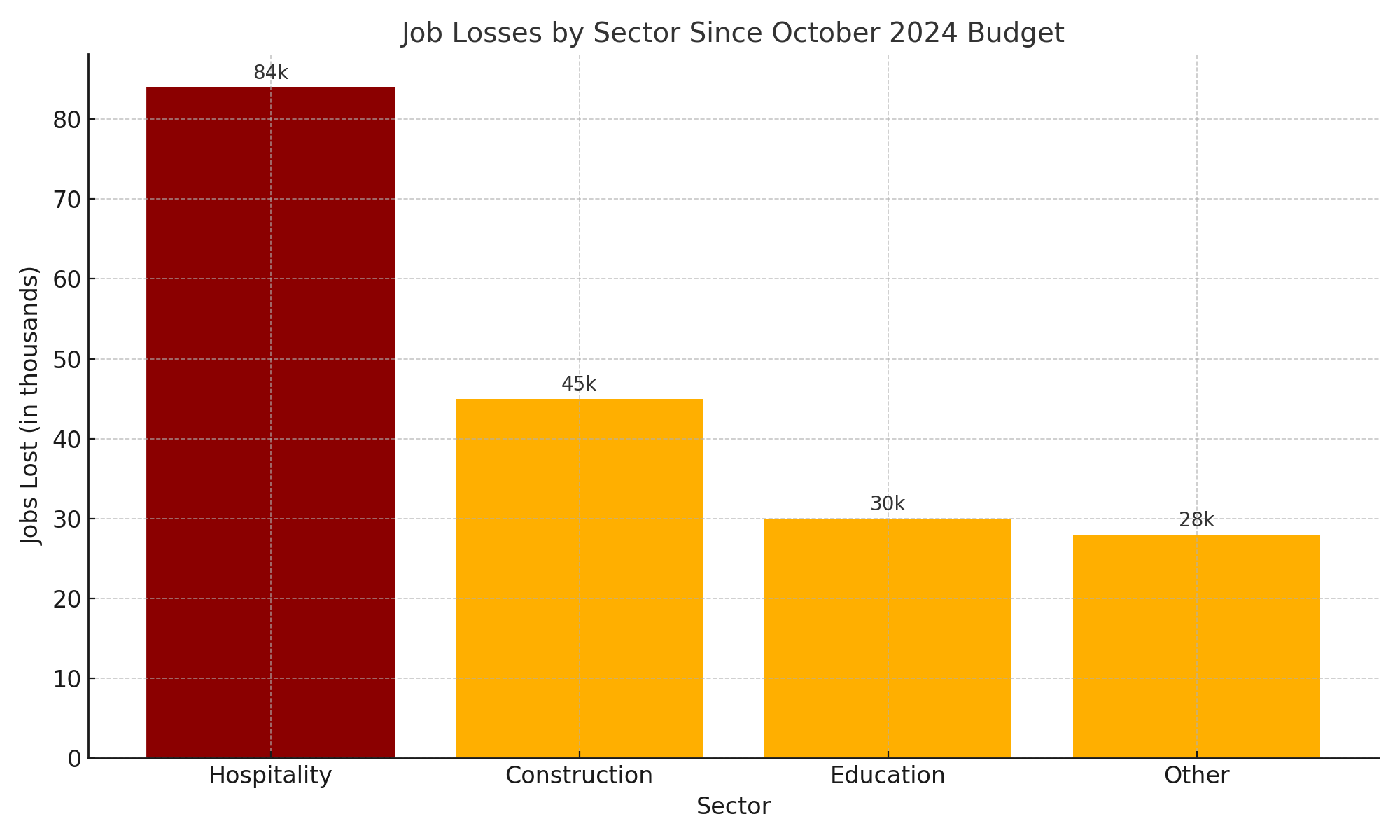

New figures from the Office for National Statistics (ONS) confirm a grim reality for one of Britain’s cornerstone industries: hospitality has lost 84,000 jobs since the October 2024 Budget, representing 45% of all job losses across the UK. That’s an average of 13,000 roles lost every month—a blow that threatens the stability of pubs, restaurants, hotels and cafés nationwide.

“We are a pro-business government creating a fairer tax system to support investment and level the playing field.” (Treasury spokesperson statement under Reeves’ leadership)

“We are a pro-business government creating a fairer tax system to support investment and level the playing field.” (Treasury spokesperson statement under Reeves’ leadership)

This alarming downturn has been directly linked to government tax reforms. Most notably, Chancellor Rachel Reeves’ Budget introduced a rise in Employer National Insurance Contributions (NICs) from 13.8% to 15%, while also lowering the liability threshold to just £5,000. These shifts, business leaders argue, have disproportionately punished labour-intensive sectors like hospitality.

The Data at a Glance

| Key Indicator | Value |

| Total hospitality jobs lost since Oct 2024 | 84,000 |

| Share of UK job losses | 45% |

| Monthly hospitality job losses | 13,000 |

| Sector vacancies (Apr–Jun 2025) | 79,000 |

| Unemployed persons per vacancy | 2.3 |

| Weekly pay (Accommodation & Food, May 2025) | £345.34 |

| YoY pay increase | 4.3% |

“These devastating job losses are the direct result of socially regressive policy decisions.” ~ Kate Nicholls (Chair, UKHospitality)

“These Losses Are Politically Engineered”

Kate Nicholls, Chair of UKHospitality, was unequivocal in her criticism:

“These devastating job losses are a direct consequence of policy decisions at last year’s Budget, which have disproportionately hit the hospitality sector.

The change to employer NICs in particular was socially regressive and had a disproportionate impact on entry-level jobs. Without a change of tack from the Government, we could be looking at even more job losses in hospitality, when we should be bringing people into the jobs market.”

Nicholls called for urgent action in the Autumn Budget, including:

- Extending NIC exemptions to young workers and those moving off benefits;

- Cutting business rates to revive high streets;

- Reducing VAT on hospitality services to stimulate investment.

“We have seen time and time again that our sector is extremely capable of meeting the Government’s growth and employment objectives—if given the optimal operational environment.”

Pubs on the Brink: “A Ferocious Tax Disadvantage”

The crisis is especially acute for Britain’s pubs, with iconic figures warning of systemic imbalance. Sir Tim Martin, founder and chairman of JD Wetherspoon, condemned the current approach:

“Higher business rates will exacerbate the already ferocious tax disadvantage that pubs are currently labouring under, inevitably resulting in increased home consumption and fewer pubs.”

Martin highlighted that pubs pay VAT on food, while supermarkets—who often undercut them on alcohol prices—do not.

“It isn’t fair that the sector has 0.4% of the rateable property but pays 2.1% of the bills.”

His concerns are not abstract. According to the British Beer and Pub Association (BBPA), one pub a day could shut this year, contributing to an estimated 5,600 job losses.

“Higher business rates are creating a ferocious tax disadvantage for pubs across the UK.” ~ Sir Tim Martin (Chairman, JD Wetherspoon)

“Higher business rates are creating a ferocious tax disadvantage for pubs across the UK.” ~ Sir Tim Martin (Chairman, JD Wetherspoon)

A “Ridiculously Disproportionate” Burden

Simon Emeny, CEO of Fuller’s pub group, argued that the business rates system has made the sector virtually uninvestable:

“If the Government continues to fail to deliver on business rates, not only will it increase pub closures … it reallydamages the viability of a sector that is absolutely critical to the UK economy.”

“Our sector carries a ridiculously disproportionate burden of the £25bn that’s currently raised from business rates. It’s long overdue that the Government found a fairer way of distributing this tax across the UK economy.”

The BBPA also noted that changes in NICs, rising energy bills, and wage increases are collectively squeezing margins past breaking point.

Treasury: “We Are a Pro-Business Government”

In response, the Treasury has defended its reforms, insisting the aim is to create a more equitable and sustainable system:

“We are a pro-business government that is creating a fairer business rates system to protect the high street, support investment, and level the playing field.”

From 2026, the Government intends to scrap the existing 40% business rates relief and replace it with lower multipliersfor properties with a rateable value under £500,000. A Treasury spokesperson added:

“Unlike the current relief, there will be no cash cap on the new lower tax rates—supporting some of Britain’s most loved high street chains to continue to create jobs and grow the economy.”

However, critics argue this simply shifts the burden from the Treasury to businesses with higher-value properties.

“Reforming business rates could support pubs at risk of closure and safeguard jobs.” ~ Nick Mackenzie (CEO, Greene King)

“Reforming business rates could support pubs at risk of closure and safeguard jobs.” ~ Nick Mackenzie (CEO, Greene King)

Business Confidence Falters

A joint survey by KPMG and the Recruitment & Employment Confederation found that redundancies are accelerating across the UK, with June seeing the fastest rise in jobseekers since November 2020. The same survey highlighted falling vacancy numbers and a sharp drop in permanent recruitment.

Nick Mackenzie, CEO of Greene King, said the current model was unsustainable:

“Reforming the business rates regime could support pubs at risk of closure.”

His message echoed across the industry: unless urgent reform is enacted, Britain’s hospitality sector faces a prolonged contraction.

Conclusion: A Tipping Point

The hospitality sector is at a crossroads. With job losses rising, closures looming, and employer costs spiralling, calls for tax reform are growing louder by the day.

As Simon Emeny warned:

“The entire investability of the sector has been challenged by the actions of successive British governments over the last decade. Now it’s time to fix what’s broken.”

Whether the Autumn Budget brings relief or more hardship may well define the sector’s future—and that of thousands who depend on it.