The UK Autumn Statement 2023

Posted by Emily on 22nd Nov 2023 Reading Time:

In a decisive move to bolster the UK economy amidst the challenges of stagflation, the government's Autumn Statement outlines a comprehensive growth strategy. This plan focuses on stimulating business investment, reducing employment taxes, notably National Insurance, and streamlining bureaucratic hurdles, especially in planning. Such a strategy is critical as the UK braces for a stagnant economic forecast in 2024, coupled with slow growth in subsequent years, primarily due to enduring productivity issues.

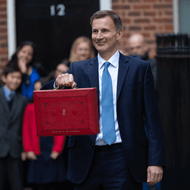

Simon Walker / No10 Downing Street, OGL 3, via Wikimedia Commons

Simon Walker / No10 Downing Street, OGL 3, via Wikimedia Commons

Jeremy Hunt says the government has taken difficult decisions to put the economy back on track and halve inflation, but "the work is not done". The Chancellor says his priorities are to avoid big government spending and high taxes and instead cut taxes and "reward hard work" with 110 "growth measures" for business.

Personal Tax

- Hunt says he will cut the main 12% rate of employee national insurance contributions by two percentage points to 10%.

- The Chancellor says this tax cut will take effect on 6 January 2024.

- He says this will affect 28 million people, saving someone on an average salary of £450.

Public Spending

- Hunt says government spending on public services will take a "responsible approach" and focus on "tackling waste".

- The OBR says the measures will result in a £19bn reduction in spending on public services after accounting for inflation.

Growth

- The Chancellor says the Office for Budget Responsibility(OBR) forecasts show the economy will grow by 0.6% this year and 0.7% next.

- It is now 1.8% larger than it was before the Covid-19 pandemic, according to the official figures, he says.

- According to the spending watchdog, inflation is expected to fall to 2.8% by the end of 2024, down from 11.1% last year when Hunt and Rishi Sunak took office.

- GDP will grow 1.4% in 2025, 1.9% in 2026 and 2% in 2027, and 1.7% in 2028.

- In March, the OBR had forecast the economy would shrink by 0.2% in 2023 before growing by 1.8% in 2024, 2.5 % in 2025, 2.1% in 2026 and 1.9% in 2027.

- The broader picture of "slower growth from a higher starting point" means that the OBR improved its forecast for GDP growth in 2027 by only 0.6% compared to March.

Inflation

- According to the spending watchdog, inflation is expected to fall to 2.8% by the end of 2024, down from 11.1% last year when Hunt and Sunak took office.

- The spending watchdog now expects inflation to stay "higher for longer" and that it will not drop to the Bank of England's target of 2% until mid-2025. This is a year later than expected in March.

- Higher inflation will keep interest rates elevated, the OBR says. It expects the central bank's key interest rate to stick at about 4% until 2028 rather than drop to 3%, as predicted in the spring.

Wages and Benefits

- Hunt says he is making the most extensive welfare reforms in a decade and will get 200,000 people into work.

- People claiming benefits will face mandatory work experience if they do not find a job within 18 months.

- As pre-announced, the "national living wage" will increase by more than a pound an hour from April to £11.44. It will also be extended to 21-year-olds.

- Benefits will be increased by 6.7%, and requirements for those who claim to be looking for work will be stricter.

- The state pension will be increased by 8.5%.

- Hunt says he will raise the local housing allowance, which has been frozen since 2020, in a measure worth £800 for some households next year.

Borrowing

- Hunt says headline debt will be worth 94% of GDP by the end of the forecast period, lower than forecast by the OBR in March.

- In cash terms, the OBR estimates the budget deficit – the gap between spending and income – is 4.5% of GDP in 2023-24.

- In its previous forecasts in March, the OBR had estimated borrowing would be 5.1% of GDP or £132bn in cash terms, in 2023-24.

- Overall, the OBR says that the course for borrowing in the next five years is "little changed" from March, as the Chancellor's new measures have wiped out any improvement.

Business Tax

- Hunt will make so-called full expensing permanent. This allows businesses to offset investment in items such as new IT equipment and factory machinery against tax.

- The chancellor adds that the measures will help increase business investment by about 1% of GDP.

- Hunt says he wants to reform taxes paid by self-employed people and will abolish their "class 2" national insurance contributions, which count towards their state pension entitlements. This will cut taxes for 2 million people, he says. "Class 4" contributions will be cut by one percentage point. Together, these will be worth £350 a year.

- There will be a business rates discount for hospitality retail and leisure worth £4.3bn.

Economy

- The Chancellor will invest an extra £4.5 billion in manufacturing between 2025 and 2030.

- About £1m will go to aerospace companies and businesses working on green technologies.

- Hunt says he will accept recommendations from a review of foreign direct investment into the UK by former business minister Lord Harrington.

- He says a new "investment zone" in Wrexham, Wales, will increase employment there. England will have three others: Greater Manchester and the West and East Midlands.

- The Chancellor says he will explore options for selling some of the government's stake in NatWest. This will be done through a "retail share offer".

Conclusion

The statement also brings relief to workers and businesses. The Chancellor's announcement of a 2p cut in national insurance, benefiting millions, and the permanent tax break for significant business investments signal a commitment to easing the tax burden. However, the OBR cautions that the tax burden could reach a post-war high by 2028/29.

Your thoughts and perspectives on these developments are invaluable.

Please share your comments below to further this important discussion.