This Week in Hospitality: Key Media Stories on the UK Hospitality Industry - Week 5

Posted by Emily on 11th Feb 2024 Reading Time:

Welcome to our weekly round-up, where we delve into the mainstream media's hospitality industry coverage. This article is crafted to inform you about the latest news, trends, and developments in the sector. We've handpicked articles from reputable sources that shed light on the dynamic and evolving world of hospitality. Our selection criteria focus on each story's significance, relevance, and impact, ensuring a comprehensive understanding of the industry's current state.

Andy Burnham backs calls for VAT cut - but told 'it ain't going to happen'

9 February 2024, Joseph Timan, Manchester Evening News

Andy Miah, CC BY-SA 2.0, via Wikimedia Commons

Andy Miah, CC BY-SA 2.0, via Wikimedia Commons

Greater Manchester Mayor Andy Burnham has publicly supported reducing VAT to 10% for the hospitality sector, speaking at the Night Time Economy Summit. This stance goes beyond the earlier suggestion by Sacha Lord, his night-time economy adviser, to lower VAT from 20% to 12.5%, the rate temporarily set post-pandemic. The proposal received backing from the mayors of Liverpool City Region and West Yorkshire, Steve Rotheram and Tracy Brabin, respectively. However, West Midlands Mayor Andy Street countered, expressing doubt about the feasibility of such a cut in the upcoming budget, instead discussing alternatives like reducing employer contributions to national insurance amid rising National Living Wage costs. The call for VAT reduction comes amidst numerous closures within Greater Manchester's hospitality industry, attributed to pandemic aftershocks and increasing energy bills. Burnham, Rotheram, and Brabin advocate for continued support for the sector, including improvements in public transport to aid accessibility to hospitality venues.

Man, 28, sues McDonald's after claiming Big Mac almost killed him

10 February 2024, Liam Buckler & Nisha Mal, Wales Online

By Phil Nash from Wikimedia Commons CC BY-SA 4.0 & GFDLViews, CC BY-SA 4.0, via Wikimedia Commons

By Phil Nash from Wikimedia Commons CC BY-SA 4.0 & GFDLViews, CC BY-SA 4.0, via Wikimedia Commons

In a shocking incident reported by Wales Online, Charles Olsen, 28, is taking legal action against McDonald's after experiencing a life-threatening allergic reaction to a Big Mac ordered through DoorDash. Despite requesting "no American cheese" due to his severe milk allergy, Olsen suffered anaphylaxis upon consuming the burger. The lawsuit, filed in February 2021, highlights the absence of allergy warnings and cross-contamination precautions on McDonald's ordering platform. Olsen, covered in hives and struggling to breathe, was urgently hospitalised. Through his lawyers, Olsen expressed frustration over handling food allergies by establishments, advocating for clear allergy listings, options for indicating allergies upon ordering, and proper staff training. McDonald's has yet to comment on the lawsuit, which seeks to compel the fast-food giant to implement comprehensive food and allergy policies. The franchise owner emphasised customer safety as their utmost priority, stating they are seriously reviewing the claims.

Super Bowl: Uber Eats advert criticised for peanut allergy joke

08 February 2024, Ashleigh Swan, BBC

shopblocks, CC BY 2.0, via Wikimedia Commons

shopblocks, CC BY 2.0, via Wikimedia Commons

Uber Eats has come under fire for its recent Super Bowl advertisement, accused of making light of peanut allergies. In the advert, which features celebrities including Jennifer Aniston and David Schwimmer and David and Victoria Beckham, a man is shown allergic to peanut butter, questioning, "Are there peanuts in peanut butter?" The Food Allergy Research & Education (FARE) charity and Food Allergy Canada have criticised the ad, highlighting the severe nature of food allergies and the potential for such jokes to encourage bullying. Despite the controversy, one affected individual saw an opportunity for Uber Eats to commit more to the food allergy community. The ad, part of the Super Bowl's highly anticipated commercial lineup, has sparked a significant backlash, calling Uber Eats to edit or remove the offensive content.

Sainsbury's announces cost-cutting drive in 'next level' changes

07 February 2024, Isabella Fish & Alex Ralph, The Times

Mtaylor848, CC BY-SA 4.0, via Wikimedia Commons

Mtaylor848, CC BY-SA 4.0, via Wikimedia Commons

In a significant strategic move, Sainsbury's, the UK's second-largest supermarket chain, has announced plans to slash costs by £1 billion over the next three years while launching a £200 million share buyback scheme. This initiative, part of the company's broader strategy to provide more choice and consistent value for shoppers, also involves refining its loyalty scheme and committing to a progressive dividend policy from the next financial year. Despite some opposition from a top shareholder regarding the share buyback, CEO Simon Roberts emphasises a balanced approach to shareholder value. The strategy builds on Roberts' "food first" focus, aimed at combating competition from discounters like Aldi and Lidl by prioritising food quality and availability. The company reported a 7.4% sales increase in the 16 weeks leading to January 6, highlighting its market share gain. Sainsbury's plans include significant investments in store remodelling for food space expansion, closing standalone Argos stores, adding convenience stores, and enhancing automation and electric vehicle charging facilities. Despite the scale of these plans, no job cuts have been announced. This move comes amid scrutiny from the Competition and Markets Authority over supermarket loyalty schemes, with Sainsbury's pledging cooperation.

Sugar refiner finds its sweet spot

08 February 2024, Caroline Bullock, The Times

Amid global upheavals ranging from Houthi attacks on cargo ships in the Suez Canal to the impacts of climate change on sugar crops, Ragus Sugars stands resilient. This Slough, Berkshire-based family business, under the directorship of Ben Eastick, is navigating the volatile sugar market with strategic supply diversification and increased stockpiling. Despite challenges such as the Covid pandemic and the war in Ukraine inflating UK sugar prices by 69% last year, Ragus has thrived, with turnovers hitting £40 million. Ragus is distinguished by its speciality in refining and blending raw cane and soft brown sugars and producing inverted syrups. It serves an elite clientele, including Heinz, Nestlé, and Unilever, while catering to the pharmaceutical and defence industries. Eastick's strategic foresight and commitment to quality and sustainability underscore Ragus's role as a vital player in the global sugar supply chain, even as it faces the sugar tax and evolving consumer preferences towards sustainability.

Amid global upheavals ranging from Houthi attacks on cargo ships in the Suez Canal to the impacts of climate change on sugar crops, Ragus Sugars stands resilient. This Slough, Berkshire-based family business, under the directorship of Ben Eastick, is navigating the volatile sugar market with strategic supply diversification and increased stockpiling. Despite challenges such as the Covid pandemic and the war in Ukraine inflating UK sugar prices by 69% last year, Ragus has thrived, with turnovers hitting £40 million. Ragus is distinguished by its speciality in refining and blending raw cane and soft brown sugars and producing inverted syrups. It serves an elite clientele, including Heinz, Nestlé, and Unilever, while catering to the pharmaceutical and defence industries. Eastick's strategic foresight and commitment to quality and sustainability underscore Ragus's role as a vital player in the global sugar supply chain, even as it faces the sugar tax and evolving consumer preferences towards sustainability.

Kellogg's Trafford Park plant closure plan puts 360 jobs at risk

08 February 2024, BBC

In a significant blow to the local economy, Kellanova, the parent company of Kellogg's Trafford Park plant in Greater Manchester, has announced plans to close the facility by 2026, jeopardising 360 jobs. The decision stems from the company's belief that there is no "long-term future" for the plant, which currently produces about one million boxes of popular cereals daily like Corn Flakes, Rice Krispies, and Coco Pops. The factory's outdated design, which includes a six-floor layout for cereal production, and the high cost of necessary investments for its maintenance were cited as key reasons for the closure. Kellanova's managing director, Chris Silcock, emphasised the challenges posed by the site's 1930s design and underutilisation of space. Kellanova has initiated formal discussions with employees and union representatives, promising support during this transition despite the planned closure. The company assured that its MediaCity office and other Wrexham and St Helens facilities would remain unaffected amidst calls from local MP Andrew Western for the company to reconsider its decision, highlighting the plant's longstanding community significance.

Yum thinks it can get half of China to eat KFC and Pizza Hut by 2026

07 February 2024, Matthew Loh, Business Insider

Dinkun Chen, CC BY-SA 4.0, via Wikimedia Commons

Dinkun Chen, CC BY-SA 4.0, via Wikimedia Commons

Yum China Holdings, operator of KFC and Pizza Hut in China aims to serve half of China's population by 2026, up from the current one-third. Announced by CEO Joey Wat during the company's quarterly results, the strategy focuses on expansion in lower-tier cities, which already house over half of Yum's Chinese outlets. The company opened over 1,500 new restaurants in 2023, bringing its total to 10,296 KFCs and 3,312 Pizza Huts nationwide, surpassing the number of KFC stores in the US and achieving significant membership growth with 470 million members across both brands. Despite China's economic challenges, Yum reported an 87% increase in net profit for 2023, reaching $827 million, and a 15% rise in revenues to $10.98 billion. The success marks a strong recovery from the impacts of COVID-19 and lockdowns, with Yum also planning to increase dividends for investors by 23%.

French cheeses' risk extinction' because of fungi decline

January 29, 2024, Adam Sage, The Times

Peachyeung316, CC BY-SA 4.0, via Wikimedia Commons

Peachyeung316, CC BY-SA 4.0, via Wikimedia Commons

French cheeses like camembert and brie are facing extinction due to a decline in essential fungi, warns the National Centre for Scientific Research (CNRS). A move towards standardised, white-rind camembert has reduced the diversity of the fungus Penicillium camemberti, crucial for the cheese's texture and flavour. This issue also threatens blue cheeses such as Roquefort, though less immediately. Historically, cheese rinds developed diverse colours and textures from natural fungal growth, but the industry's shift to cloned fungi strains for a more uniform appearance has severely limited genetic diversity among these microorganisms. The CNRS highlights the need for sexual reproduction in fungi to maintain diversity and suggests that cheese lovers may need to embrace flavour, colour, and texture variations to preserve these traditional cheeses.

Struggling EU hotel chain launches furious Brexit rant as it's 'forced to raise salaries'

3 February 2024, Astha Saxena, The Express

In a recent outburst, Gabriel Escarrer, the CEO of Melia Hotels International, criticised Brexit for exacerbating the labour shortage in the UK, compelling the Spanish hotel giant to increase salaries significantly. Operating numerous establishments across the UK, Melia has seen labour costs rise by 13 per cent in 2023 due to difficulties filling positions, particularly in the tourism sector. Escarrer pointed out that the post-Brexit environment has made it challenging to attract the necessary talent, leading to salary increments beyond initial budgets. Despite these challenges, Melia is determined to continue its expansion, planning to open 20 new hotels, including luxury offerings, in 2024. The company, a key player in the Balearic Islands alongside Air Europa and Hotelbeds operates 160 hotels in Spain and employs 17,690 people worldwide.

'It's sad': is the UK real living wage under threat as Capita and BrewDog pull out?

06 February 2024, Heather Stewart, The Guardian

Jeremy Segrott, CC BY 2.0, via Wikimedia Commons

Jeremy Segrott, CC BY 2.0, via Wikimedia Commons

In an unsettling trend for the UK's low-paid workers, Capita and BrewDog have recently announced their withdrawal from committing to the real living wage, an initiative to ensure workers can afford necessities. This decision comes after significant economic inflation, which saw the real living wage rise to £12 an hour. The move has sparked concerns among unions and employees about the growing financial pressures on businesses and the potential domino effect on other companies. The Communications Workers Union (CWU) at Capita seeks ways to challenge the decision, citing the disparity between executive earnings and the plight of the lowest earners. Despite these setbacks, the Living Wage Foundation remains optimistic, highlighting the growth in the network of employers committed to the wage. The article underscores the broader economic challenges and debates surrounding wage policies in the UK, including the impending increase in the mandatory national living wage and the tensions it creates within the workforce. The commitment of several employers to uphold the real living wage, despite cost challenges, reflects an ongoing debate about corporate responsibility and economic sustainability in a rapidly changing economic landscape.

When Spoons shuts: how chain pub closures are crippling communities across the UK

31 January 2024, Fred Garratt-Stanley, TimeOut UK

Paul the Archivist, CC BY-SA 4.0, via Wikimedia Commons

Paul the Archivist, CC BY-SA 4.0, via Wikimedia Commons

Fred Garratt-Stanley's article in TimeOut UK sheds light on the significant impact of JD Wetherspoon pub closures on UK communities. Highlighting the closure of The Capitol in Forest Hill and the sale of The Rochester Castle, among others, the piece examines the broader implications of 35 Wetherspoon venues closing or being put up for sale due to financial pressures exacerbated by the cost of living crisis, Brexit, and the pandemic. The closures are not just a loss of affordable dining and drinking options; they signify the erosion of community hubs that served as vital social spaces for many. With the rise of alternative pub chains like Craft Union, the article explores the shifting landscape of the British pub scene. Still, it underscores Wetherspoons' unique role in fostering social cohesion and offering a welcoming space for diverse communities. Through interviews with affected locals and industry insiders, Garratt-Stanley captures these closures' personal and communal toll, framing them against broader economic and social challenges.

Warning new 'taxi tax' could lead to five million fewer trips to restaurants and pubs a year

5 February 2024, Matt Mathers, The Independent

The hospitality industry faces a potential decline due to the UK government's "taxi tax," which could result in 5 million fewer journeys to pubs and restaurants annually, significantly impacting the sector's recovery post-pandemic. This new legislation mandates minicab firms to charge VAT on their fares, potentially increasing costs by 20% amid the ongoing inflation and cost of living crisis. With 15 million people using minicabs for such outings last year, a YouGov survey indicates that a third would reduce their usage with the fare hike. The High Court's ruling that taxi firms are liable for VAT, not drivers, challenges the current tax exemption for independent drivers below the £85,000 threshold. This change could also affect ride-hailing services like Uber, Bolt, and traditional taxi companies. Amid widespread opposition to the tax increase, campaigners and industry leaders urge the government to reevaluate to support the struggling hospitality sector and prevent further financial strain on consumers and businesses.

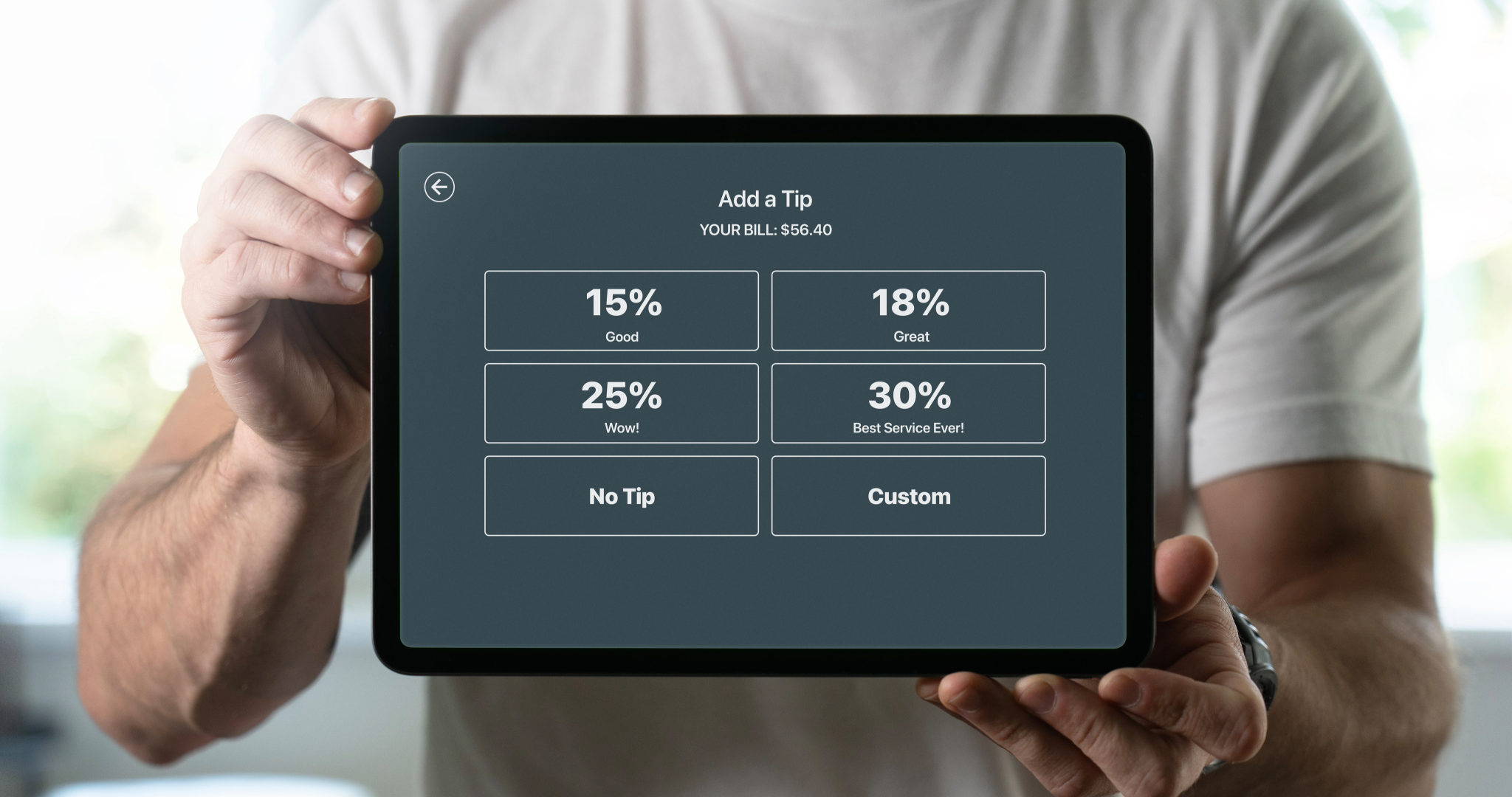

Spare me the American-style service charge - I'll decide whether you deserve a tip

05 February 2024, Johnny Jenkins, LBC

In his LBC article dated 05 February 2024, Johnny Jenkins challenges the growing trend of automatic service charges in UK restaurants, advocating for tipping to remain a voluntary reward for good service. Jenkins expresses his love for eating out and his support for the hospitality industry, sharing personal experiences where a predetermined 12.5% service charge on bills undermines the principle of tipping as a discretionary gesture. Reflecting on his time working in hospitality, he emphasises that tips should be earned, not expected, and highlights customers' awkwardness when contemplating whether to ask for the charge to be removed. Jenkins also recounts stories illustrating how this practice can detract from the dining experience, including being chased for a service charge after poor service and automatically charged for service when no direct service was provided. While this model may be prevalent in America, he asserts that it should not become the norm in the UK, where exceptional service should be voluntarily recognised and rewarded.

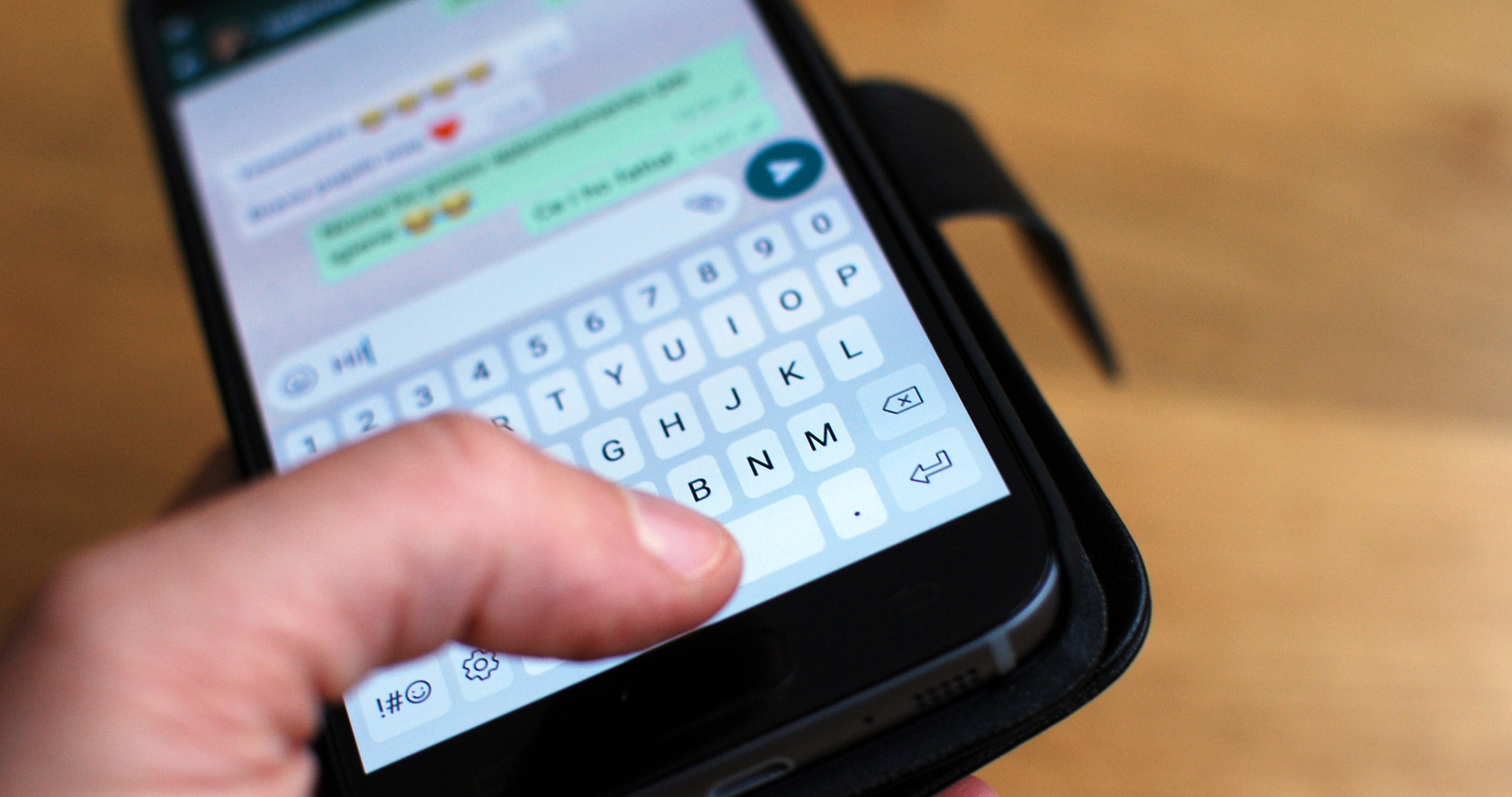

Covid WhatsApps a 'real slap' for hospitality businesses, says industry leader, after Nicola Sturgeon messages revealed

05 February 2024, Alistair Grant, The Scotsman

The unveiling of WhatsApp messages during the UK Covid Inquiry has sparked outrage among hospitality leaders, with Stephen Montgomery of the Scottish Hospitality Group calling the revelations a "real slap" for the sector. The disclosed communications, involving high-profile figures such as Nicola Sturgeon and Jason Leitch, suggest an ad-hoc approach to pandemic rule-making, particularly regarding mask-wearing and hospitality restrictions. Critiques focus on the seeming randomness of decisions and the challenges they present to business owners. Additionally, the inquiry uncovered a message from Humza Yousaf, hinting at a lax attitude towards mask enforcement. This incident, along with others, underscores the frustration and difficulties faced by the hospitality industry during the pandemic. The article also touches on broader issues, including a potential new tax on retailers selling alcohol or tobacco, sparking concern among retail leaders and unions over the impact on Scotland's retail sector.

BP is now a big producer of an unexpected commodity: coffee

06 February 2024, Steve Goldstein, MarketWatch

grassrootsgroundswell, CC BY 2.0, via Wikimedia Commons

grassrootsgroundswell, CC BY 2.0, via Wikimedia Commons

In an intriguing shift within the energy sector, BP, traditionally known for its oil production, has emerged as a significant player in the coffee industry. As Steve Goldstein for MarketWatch reported on February 6, 2024, BP's venture into the coffee business through its convenience stores has proven lucrative. These stores, part of BP's extensive network of 21,100 retail sites, including 2,850 strategic convenience sites, offer gasoline and have become popular spots for coffee enthusiasts, selling 150 million cups annually. This diversification has contributed to a 9% increase in BP's convenience gross margin, reaching $1.66 billion last year. The success is partly attributed to the rising number of electric-vehicle owners who, while charging their vehicles, spend more at BP's retail outlets than fuel customers. This trend reflects a broader positive performance within the oil industry's retail sector, with companies like Shell and Exxon Mobil also reporting gains from their service stations.

Conclusion

In this week's comprehensive overview of the UK hospitality industry, we've navigated through a diverse landscape of challenges and innovations that continue to shape the sector, from Andy Burnham's advocacy for VAT reductions to bolster the nightlife economy to the dire consequences of ignoring food allergies as spotlighted by lawsuits against McDonald's and criticism of Uber Eats' advertising. The strategic shifts of giants like Sainsbury's and Kellogg's reflect the ongoing adaptation to economic pressures and market demands. At the same time, the resilience of specialised businesses like Ragus Sugars against global disruptions showcases the importance of strategic foresight.

Moreover, the international ambitions of Yum China Holdings contrast with the local struggles within the UK hospitality sector, as Brexit and labour shortages force companies like Melia Hotels International to recalibrate. The potential extinction of traditional French cheeses and the debate over the real living wage in the UK highlight the intricate balance between preserving heritage and addressing contemporary economic realities. The closure of JD Wetherspoon pubs and the controversy over new taxes affecting taxi services and restaurant tips underline the critical role of community and consumer engagement in the industry's survival and growth.

These stories, from policy debates to market strategies and the individual challenges of businesses and consumers, encapsulate the dynamic interplay of global trends and local impacts within the UK hospitality sector. They underscore the importance of innovation, adaptability, and the collective effort of industry stakeholders to navigate the complexities of today's economic landscape, ensuring the vitality and sustainability of hospitality as an essential facet of daily life and cultural heritage.