Why the Plant-Based Boom is Facing Challenges

Posted by Emma on 28th Feb 2025 Reading Time:

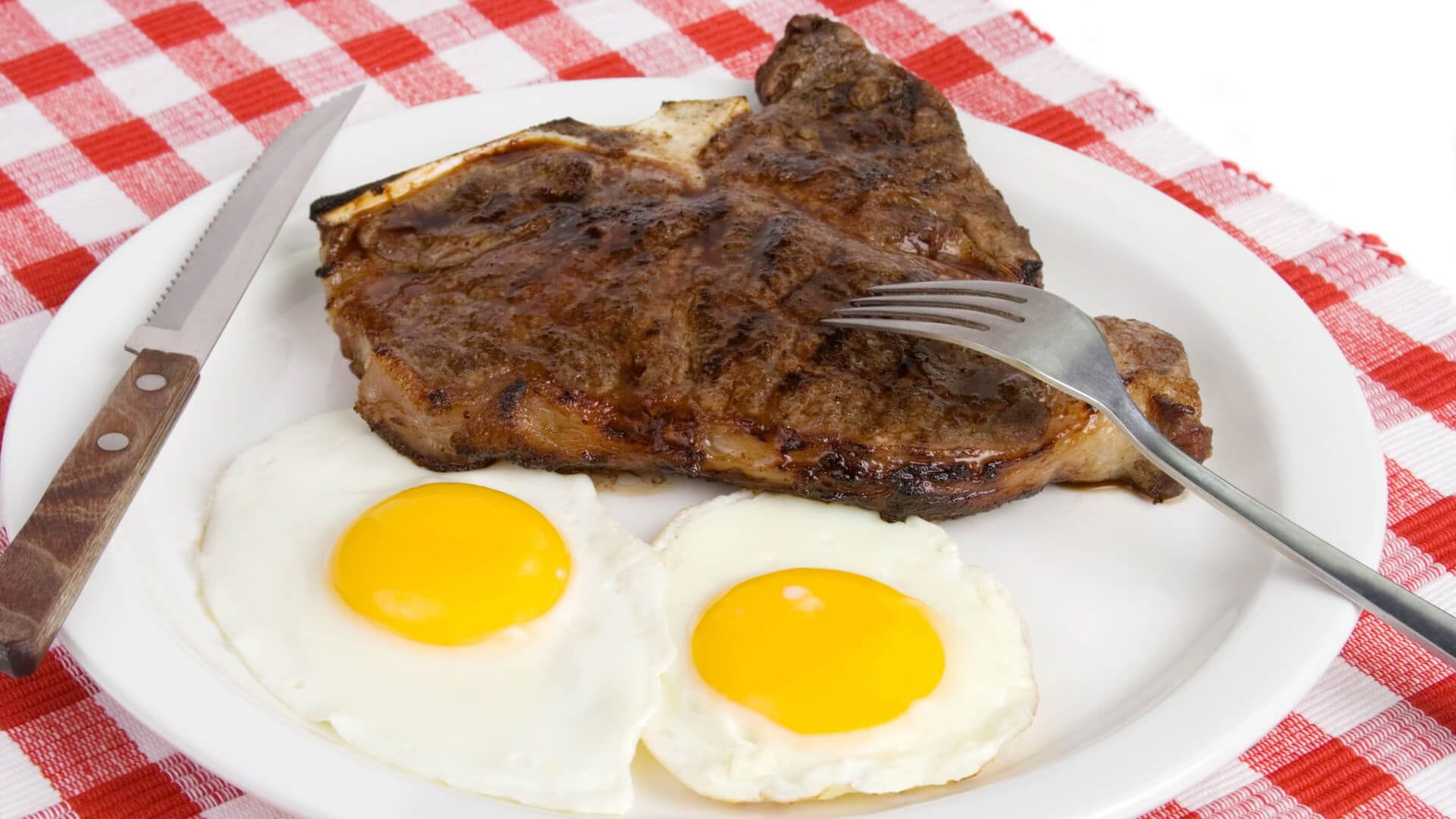

For the past decade, we've been told that the future is plant-based. Investors poured billions into lab-grown meat and ultra-processed vegan alternatives, convinced they were backing the next food revolution. Yet here we are in 2025, and the plant-based market is slowing, meat sales are climbing, and the so-called "protein transition" hasn't unfolded as expected.

Aleph Farms, one of the most hyped names in lab-grown meat, has spent a staggering $140 million of investors' cash and still hasn't sold a single kilogram of its product. It's scrambling to secure another $25 million to keep the lights on. Meanwhile, back in the real world, beef sales in the UK surged last year, plant-based alternatives continued their four-year decline, and Gen Z—the very demographic that was expected to drive plant-based adoption—is eating more meat than ever.

So what went wrong? Simply put, the market hasn't embraced plant-based alternatives at the scale many predicted.

Investors Overestimated Demand, Consumers Chose What Works for Them

For years, we've heard that people are moving away from meat in favour of lab-grown steaks and pea-protein burgers. In reality, sales of chilled meat alternatives have declined by 38% in just two years. Even in Sweden—a country known for its strong environmental commitments—24% of people reported increasing their meat consumption in 2024. In the US, the number of so-called "flexitarians" has dropped from 18% to 12% over the past four years. The trend of reducing meat intake has slowed; in some places, it's reversing.

Why? Because people are becoming more informed about nutrition. Thanks to social media and a growing awareness of nutrient density, consumers realise that the best protein and essential nutrient sources are often whole, natural foods rather than highly processed substitutes. The idea that we were inevitably heading toward a "protein transition" was an optimistic prediction rather than a market reality.

The Plant-Based Market is Adjusting

The shift away from plant-based eating has had real consequences for businesses. Beyond meat, once hailed as the future of protein, has seen its stock price fall by 98% since its peak. Pret A Manger closed or converted its last remaining Veggie Pret outlets due to low demand. Even celebrity-backed ventures have struggled—Neat Burger, supported by Leonardo DiCaprio and Lewis Hamilton, shut down half of its UK locations last year after significant financial losses.

Dairy-free brands have also seen setbacks. Oatly launched its vegan ice creams with much fanfare in 2019 and pulled them from UK shelves in 2023. Nestlé abandoned its Wunda and Garden Gourmet plant-based ranges. Innocent Drinks discontinued its dairy-free smoothies. While plant-based eating remains a preference for some, the market is adjusting to a lower demand level than initially expected.

A Shift in Consumer Preferences

This trend isn't just about business—it's cultural as well. Over the last decade, many meat-eaters felt that they were being pressured into plant-based choices by aggressive marketing and social movements. Now, the tide is turning. The number of self-identified vegans in the UK remains small, likely no more than 600,000 core adherents. The rest were casual participants, open to trying new products but not fully committed to eliminating animal products from their diets. As the downsides of highly processed vegan alternatives became clearer, many consumers returned to what worked for them.

Even celebrities are rethinking their diets. Last year, Lizzo—who had been a vocal advocate for veganism—publicly stated she was no longer vegan after a trip to Japan, which convinced her that animal protein was essential for health. She admitted, "It can be scary talking about things like this because veganism is such a sensitive subject."

A Return to Balance

Chefs are also seeing this shift play out in their restaurants. Mark Hix, David Taylor, and Paul Askew all report that their customers are more interested in authentic, seasonal, and sustainable food than the latest plant-based trend. People are looking for high-quality, nutrient-dense meals rather than ultra-processed alternatives.

Even butchers have noticed a change. Tony Hindhaugh, co-founder of Parsons Nose, recalls being approached a few years ago by a company wanting to turn his shop into a vegan pop-up. "We said no—it goes against everything we stand for."But at the time, he admits, he was worried about the future. Today, that concern has eased. "We've noticed more people coming back to meat. Some of our old customers experimented with veganism, but we've welcomed them back with open arms—and free sausages."

Where Do We Go From Here?

This doesn't mean veganism is disappearing. There will always be a market for plant-based products, and consumers still prefer these options for ethical, environmental, or health reasons. However, now, the expectation that the entire food system would transition away from animal protein seems unrealistic. Instead, we're seeing a correction—where plant-based foods find a more sustainable place in the market rather than being treated as an inevitable future.

So, to all the investors who thought they could "disrupt" the food industry overnight, it might be worth paying closer attention to what consumers actually want next time.