Digital Transformation Takes Centre Stage as McDonald's Innovates to Stay Ahead

Posted by Emily on 21st Oct 2023 Reading Time:

Despite the prevalent inflation fears that coloured 2022, one American fast-food giant, McDonald's, seems to have found a solution.

In October, McDonald's reported robust financial results for the third quarter, attributing this success to significant investments in digital strategies and the ability to pass higher costs to customers.

Digital might not be the first aspect investors associate with McDonald's. Known worldwide for its burgers and fries, the Chicago-based company has, for decades, maintained consistency in the taste and presentation of its meals, irrespective of the global location. While scale remains crucial, since 2017, the focus has shifted towards guiding customers down a more profitable route.

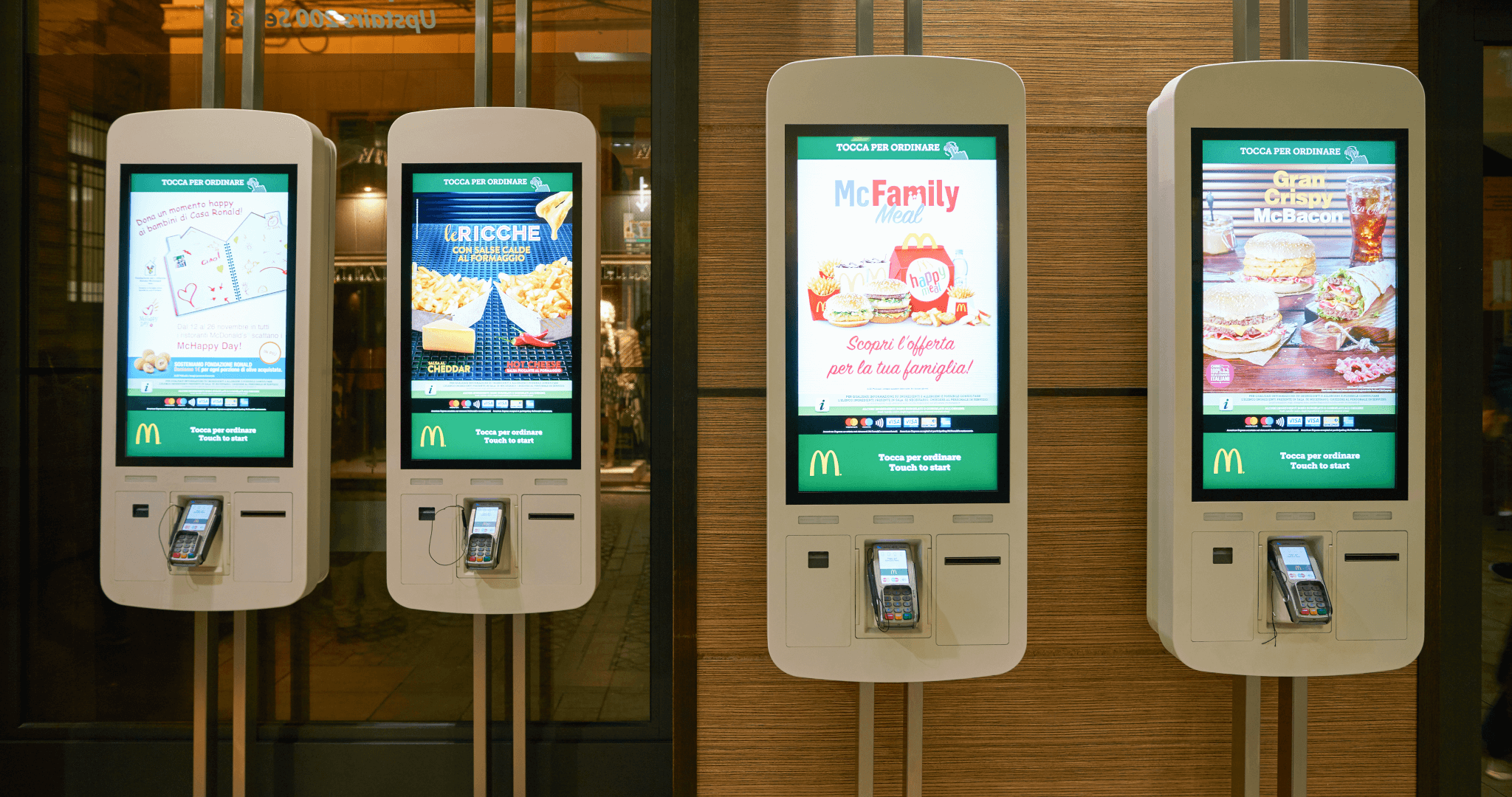

McDonald's is globally channelling substantial investment into self-ordering kiosks, mobile applications, and dynamic technology for drive-thru customers. These innovations aim to streamline the ordering and payment processes, boosting sales per hour and enhancing profits.

In the late 1920s, Dick and Mac McDonald ventured from New England to California, aspiring to success in the film industry. However, by 1940, they were fully immersed in the drive-in restaurant business. Their revolutionary Speedee Service System, launched in 1948 in San Bernardino, offered limited choices but quicker service, immediately setting a new standard for efficiency. McDonald's started selling their 15-cent hamburgers as rapidly as possible.

Continuing the quest for efficiency, today's executives identified that bypassing the ordering window altogether, thus promoting self-service through in-store kiosks and the McDonald's app, paves the way for greater profits.

In major markets, 70% of sales come from customers who stay in their vehicles. A complex order can slow down service and dent profitability.

In 2019, McDonald's acquired Dynamic Yield for $300 million. This Israeli startup specialises in using artificial intelligence to adapt real-time menu displays, considering the weather, previous customer choices, and local preferences.

The integration of this technology enhances the personalisation of the customer experience. It adjusts the digital drive-thru menu based on various criteria and suggests additional items based on current selections. This forward-thinking approach places McDonald's among the pioneers in applying decision technology directly at the point of sale in physical locations.

Following the acquisition, McDonald's will assume full ownership, further investing in Dynamic Yield's core product and team. Dynamic Yield will operate independently, continuing to serve existing and new clients.

Other digital initiatives include image recognition to identify returning customers via license plate scanning and natural language processing algorithms for automated ordering. These strategies contributed to reducing drive-thru service times by one minute in 2021 in the U.S.

These approaches proved beneficial during the pandemic and have continued to amplify their advantages. In the face of global inflation and supply chain issues leading to increased costs, digital strategies are mitigating these impacts, enhancing customer loyalty, and enabling McDonald's to maintain pricing strategies.

Chris Kempczinski, CEO, highlighted in October that heightened U.S. restaurant traffic increased Q3 sales by 6.1% compared to the previous year. Global same-store sales rose by an impressive 9.5%, surpassing analyst expectations. Notably, markets in the UK, Germany, France, and Australia experienced significant expansion, while sales in China suffered due to persistent COVID-19 restrictions.

Q3 earnings soared to $1.98 billion, or $2.68 per share, as detailed in documents filed with the Securities and Exchange Commission. Despite a tumultuous 2022, McDonald's stock rose by 10%, contrasting with the S&P 500's 19.6% decline. With shares priced at $278.40, trading stands at 26.6x forward earnings and 8.8x sales, supported by a strong operating margin of 42.5%.

Though the days of 15-cent burgers are long past, McDonald's enduring commitment to efficiency remains relevant, especially amidst global economic challenges. It presents a compelling narrative for long-term investors, merging a legacy of innovation with future-focused resilience.