Interest Rates Remain Steady After 14 Consecutive Increases

Posted by Emily on 21st Sep 2023 Reading Time:

In an unexpected turn of events, the Bank of England has chosen not to increase UK interest rates, observing a quicker-than-anticipated decline in price increases. The rates stand firm at 5.25%, a peak not witnessed for a decade and a half. This announcement follows recent data revealing a deceleration in inflation for August.

The Bank of England's governor, Andrew Bailey, mentioned, "In the past few months, inflation has seen a significant drop, and it's likely to keep doing so." He also highlighted concerns regarding the negative impact of the continuous rate hikes on the British economy.

The Bank of England had previously increased rates 14 times, aiming to control the rising inflation. Such hikes have resulted in an uptick in monthly payments for mortgages and loans, though they've also boosted rates for savers.

Although most experts had foreseen another rate hike, maintaining the rate suggests a potential shift in the financial climate. Mr Bailey, while speaking with the media, emphasised the need for caution, indicating the long journey ahead to achieve the BOE's inflation target of 2%. He also dismissed the idea of a rate decrease anytime soon.

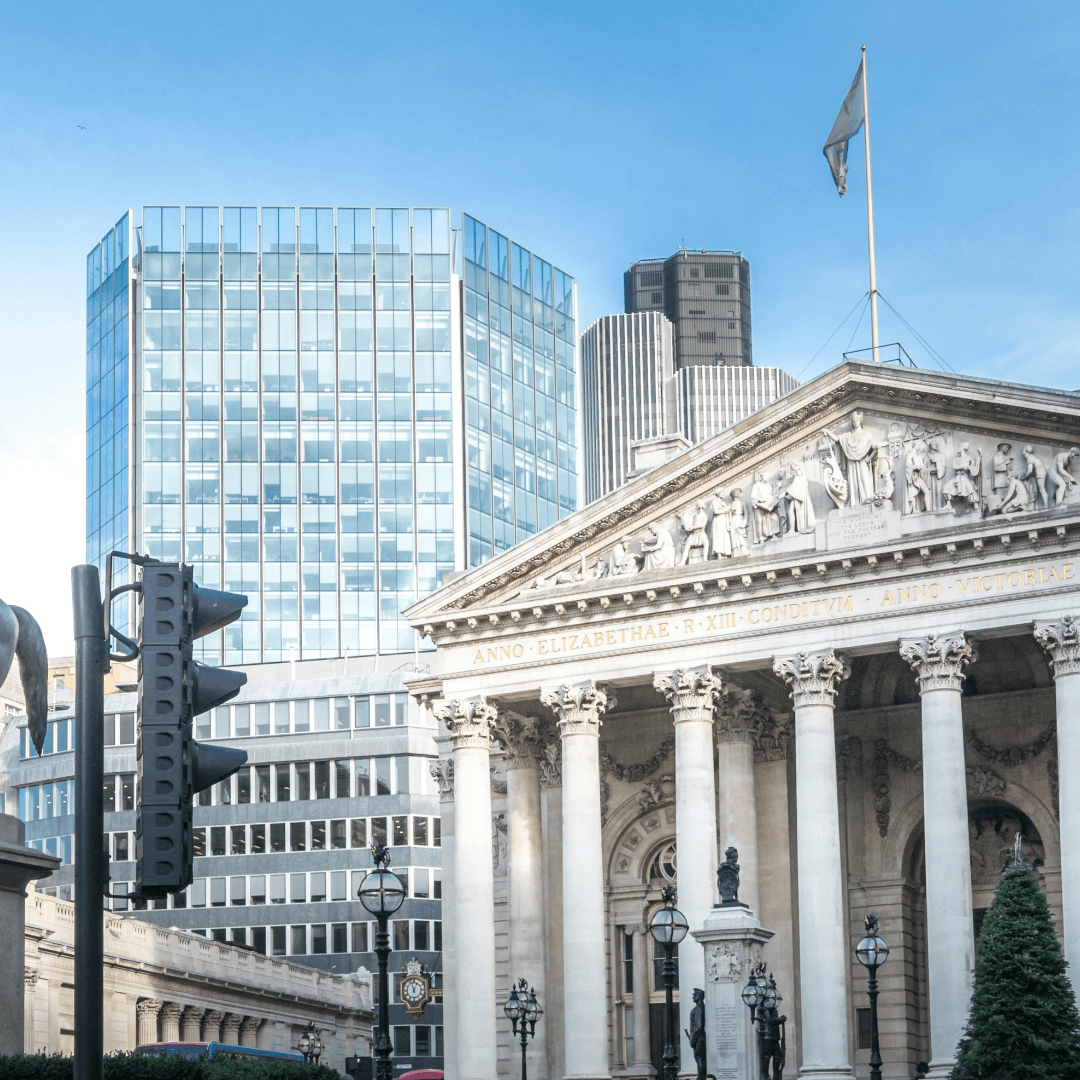

Image Source:UK Government, CC BY 2.0, via Wikimedia Commons

The rate decision was narrowly settled, with the nine-member Monetary Policy Committee (MPC) split almost evenly. The recent inflation statistics, indicating a reduction in living costs, ultimately persuaded the Bank of England that their approach yielded results.

Chancellor Jeremy Hunt expressed optimism: "We're observing a reversal in high inflation trends. We remain committed to assisting households with mortgage burdens."

However, the Bank and the Treasury heed the International Monetary Fund's caution against celebrating prematurely, referencing past inflation challenges.

Homeowners with tracker mortgages might feel a slight relief from this decision. Moreover, those nearing the end of their fixed-rate terms could hope for stable mortgage rates. Lenders might now be encouraged to present better deals if this marks the end of consecutive rate hikes. Still, the market speculates that this might only result in a rate stabilisation rather than significant reductions.

As for savers, the returns they currently enjoy might not see further enhancements. Thus, seeking the best deal might be more crucial now.

Higher interest rates usually deter borrowing and spending, potentially slowing down price hikes by firms. Yet, striking a balance is essential as too many hikes could reduce household expenditure, affecting businesses and the overall economic growth.

The MPC noted the surprising drop in inflation since June, reaching 6.7% in August. Despite the economic growth being slower than anticipated, the decision was to keep rates steady. They emphasised the importance of strict measures for a considerable duration to achieve the desired 2% inflation, which might only be realised by 2025. The possibility of more hikes isn't ruled out if inflation trends reverse.