Unilever's Strategic Overhaul: Spinning Off Ice Cream

Posted by Emma on 4th Apr 2024 Reading Time:

Unilever, the conglomerate behind beloved brands like Marmite and Magnum, is taking decisive action to rejuvenate its business. The company announced it will separate its €8 billion ice cream division, representing 16% of its sales and including iconic names like Ben & Jerry's and Wall's. This move is a strategic decision to enhance focus and efficiency, aiming to streamline operations by doing "fewer things better."

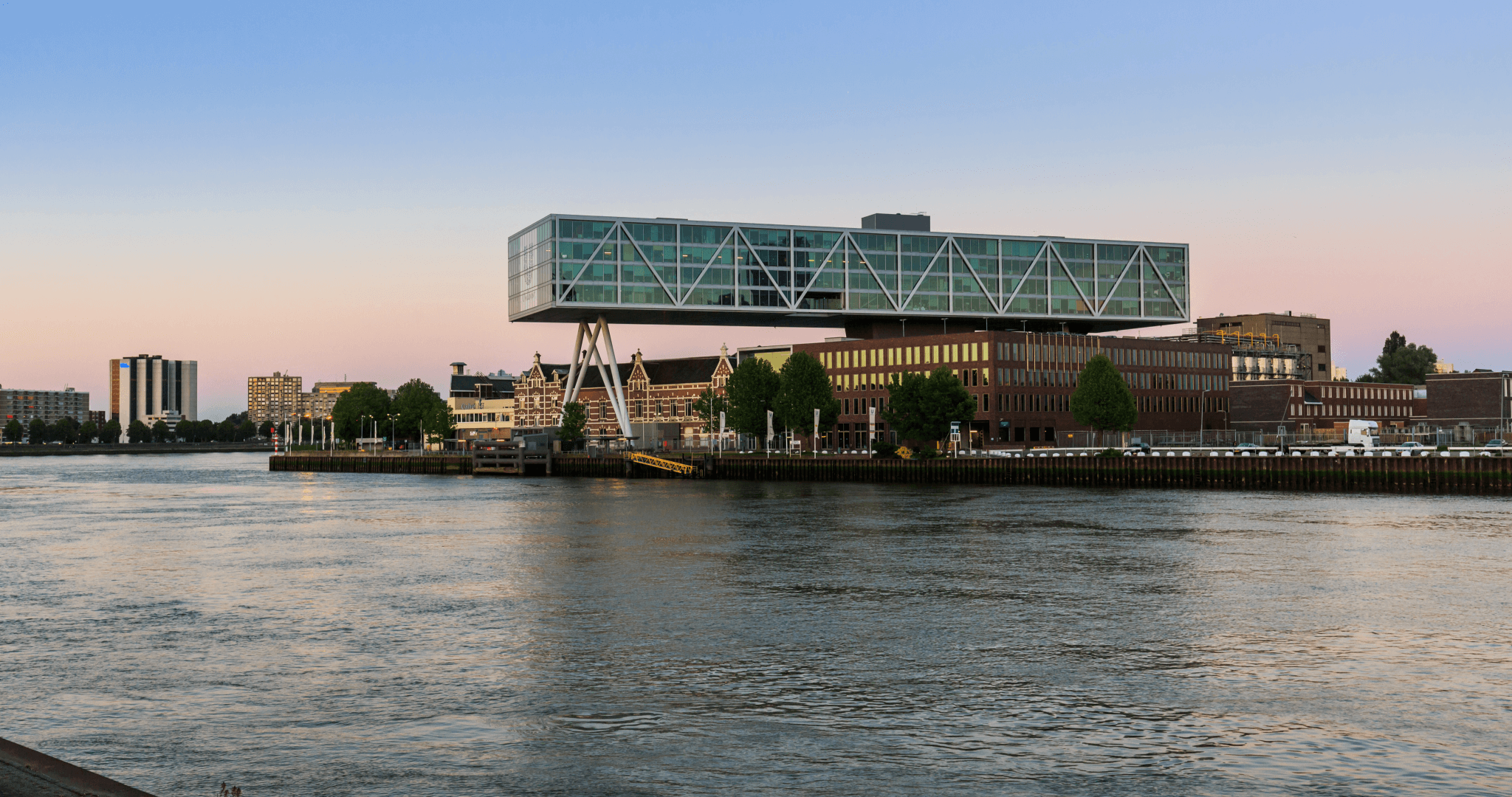

Since June, Hein Schumacher, Unilever's CEO, has been steering this change amid pressures to improve the company's performance. He indicated that a demerger is the preferred strategy, leading to an independent listing of the ice cream business. However, other options remain on the table. The specific listing location is undecided, but Schumacher hinted at Amsterdam, noting the division's operational base in Rotterdam and its transition to a new Amsterdam headquarters.

Analysts suggest that Unilever opted to spin off its ice cream sector due to challenges in finding a buyer at a suitable price, with valuations reaching up to €17 billion. The announcement spurred a 5% increase in Unilever's stock price, underscoring market approval of the strategic pivot.

This restructuring, which includes cutting 7,500 jobs, is part of Schumacher's broader initiative to enhance shareholder returns. Despite a nearly 10% decline in Unilever's stock over five years, this move contrasts with the performance of competitors like Procter & Gamble, highlighting the need for strategic realignment.

Unilever's decision to separate from its ice cream division stems from unique challenges related to its seasonal nature and expensive supply chain, which lacks synergy with other business units. Schumacher emphasises the goal of refining focus for greater impact, acknowledging the ice cream business's distinct operational needs.

The restructuring has been met with optimism, as Terry Smith of Fundsmith, Unilever's tenth-largest shareholder, applauded the move. He noted past issues with Ben & Jerry's governance as a complicating factor for the division.

Analysts recognise the logic behind the separation, citing the ice cream division's slower growth and unique expensive logistical requirements. However, they caution that achieving full separation by the end of 2025 could introduce complexities, including the potential for "stranded costs," a challenge Unilever has faced in past divestitures.